About Wells Fargo

Wells Fargo is too big and well-established to ignore, but if you're not careful, the fees can outweigh the benefits

Wells Fargo is the third biggest bank in America and prides itself on being a one-stop financial institution for all of its 70 million customers. It is a banking giant, consistently ranked by personal finance sites as one of the best brick-and-mortar banks in America.

With credit cards, checking and saving accounts, loans, mortgages and insurance, Wells Fargo's products meet industry standards, but aren't exceptional.

So what sets Wells Fargo apart? Everything under one roof means fewer headaches and fewer worries for customers.

However, there are a lot of fees. Even though many can be waived, fees remain one of the biggest complaints customers have about Wells Fargo

Overall, Wells Fargo is a strong choice if you're looking for a brick-and-mortar bank that offers everything under one roof. Keep reading to see what else is liked, and disliked, about this bank.

Is it the best bank for you?

Depending on what you're looking for in a bank, Wells Fargo may or may not be the best bank for you.

Answer these questions to determine if Wells Fargo has what you need.

Do you value an easy-to-use online banking experience with all the bells and whistles?

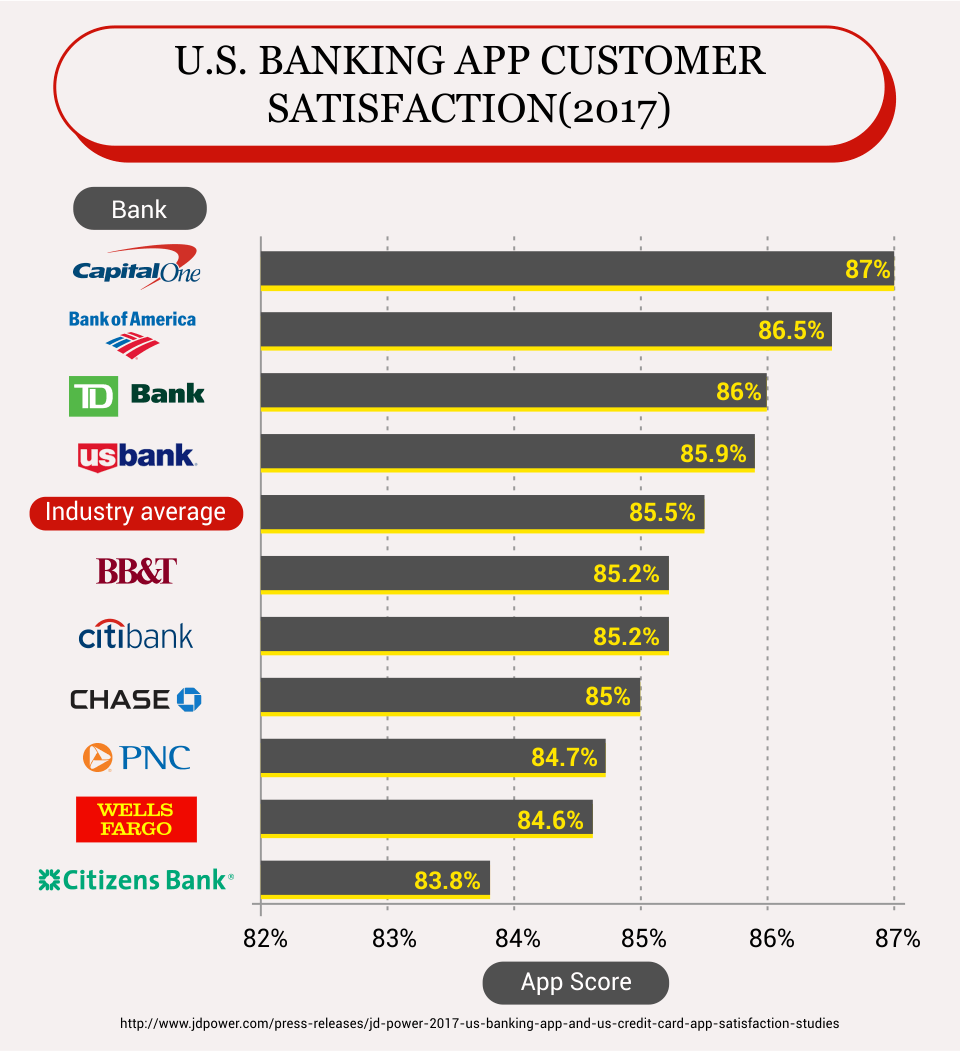

With robust online banking, a mobile app with instant check deposit, and text banking are some of the ways in which Wells Fargo makes it easy for customers to bank on the go.

But if the online and mobile options seem too overwhelming, then you may want to check out local or national credit unions instead.

Are you looking for a bank that can travel with you within the United States?

With branch locations in all 50 states and nearly 13,000 ATM locations spread across the country, Wells Fargo is great for in-person interactions and cross-country travel.

But if you're looking for a bank that is great for international travel, then you might want to look at other banks or credit cards instead.

Most Wells Fargo cards charge $5 per ATM transaction plus 3% of every purchase when spending abroad.

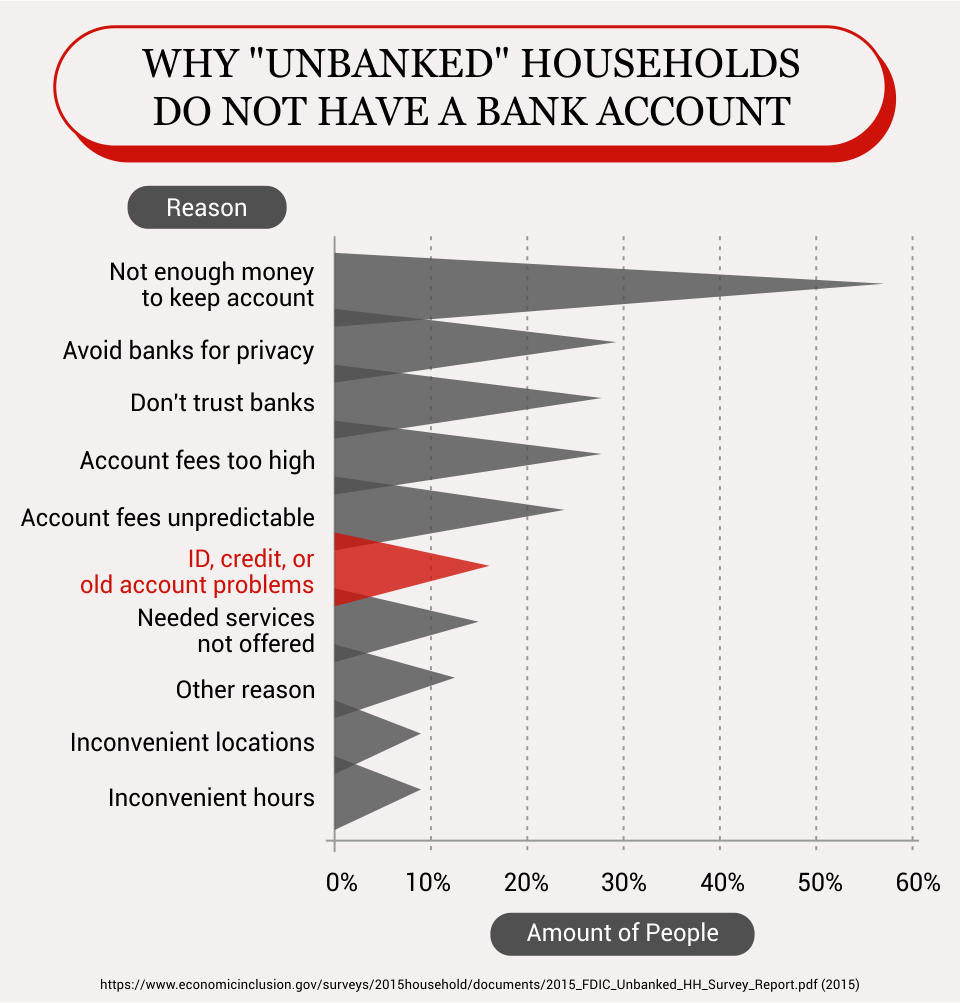

Do you need a second a chance at banking?

If you've denied the opportunity to open a checking account at other banks due to bounced checks, bad credit or a history of overdraft fees, then Wells Fargo Opportunity Checking and Savings account might be the answer.

The account is specifically designed for customers who haven't been able to open a banking account due to past mistakes.

If not, you may have more flexibility in your banking options and might want to look at savings accounts with higher interest rates or other perks.

Wells Fargo Customer Reviews

Positive Consumer Reviews

Bank with Wells Fargo and you'll get nationwide branch access, excellent credit card rewards, and 24/7 mobile banking

Named the best brick-and-mortar national bank of 2016. Thanks to branches across the nation, a trustworthy history, and low account fees, Wells Fargo has been named the best brick-and-mortar bank by multiple sites.

Nationwide locations make it simple. In an increasingly digital world, customers who value in-person access and interactions across multiple states appreciate Wells Fargo.

Great customer service makes it enjoyable. According to customer reviews, the country-wide locations and Wells Fargo mobile access are even better thanks to excellent customer service from Well Fargo advisors.

"Wells Fargo [offers] professionalism and excellent customer service compared to Chase and Bank of America, where I have banked before. Every encounter I've ever had—be in person, via the web or on the phone—has always been a very positive experience.

The people I [have] interacted with are courteous and appeared truly happy to be of service…," writes Andrea from Houston, Texas.

Rewards that you will actually use. A lot of banks pride themselves on providing credit card rewards, but with Wells Fargo credit cards and Go Far Rewards, you can earn rewards on everyday purchases and apply them towards travel, donations, cash back, or shopping.

Customers value the rewards and also appreciate that all aspects of the bank provide value. "Online bill pay is a breeze, rewards are good on their credit card, and CD rates are competitive," says Mary from Villa Rica, Georgia in her Wells Fargo bank review.

Unsecured loans simplify the borrowing process. Wells Fargo is one of the only big banks to offer unsecured loans that do not require customer collateral.

Creditworthiness is the only factor used to determine your loan.

Small business banking at its best. With small business loans, a partnership with the Small Business Association, checking accounts, and business credit cards with no fees, Wells Fargo is known for taking good care of small business owners.

Negative Consumer Reviews

The fees at the bank will add up fast if you're not committed to tracking your spending and jumping through hoops

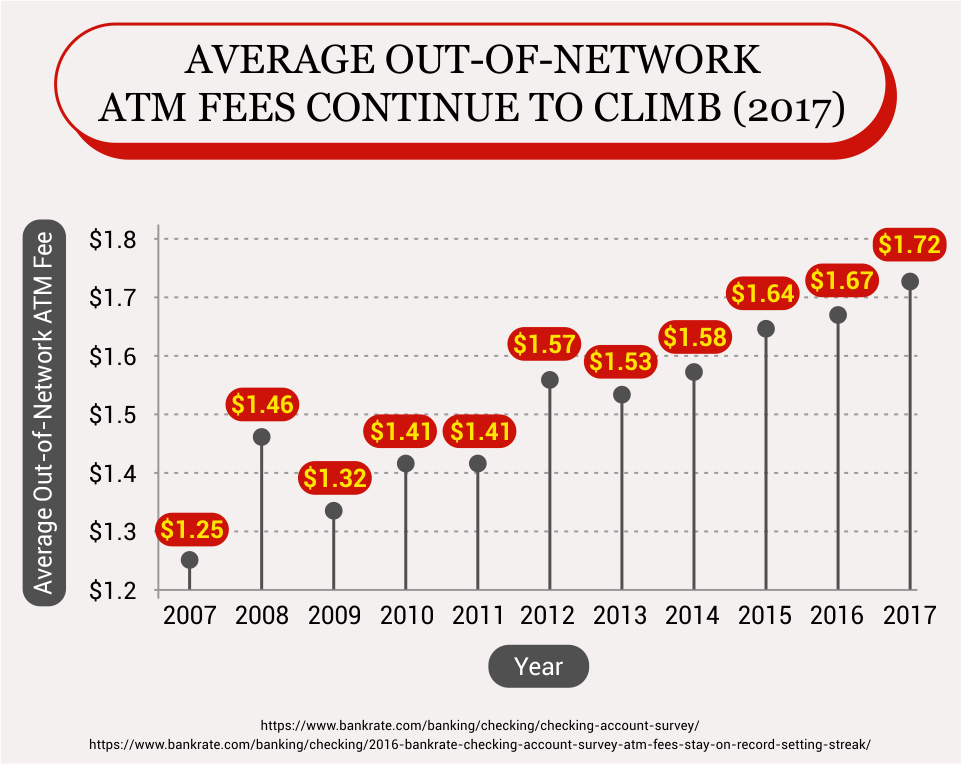

Out-of-network ATM fees. You'll be charged $2.50 for using "out-of-network" ATMs.

In addition, the ATM operator will also charge a $2-$4 fee.

If you use an out-of-network ATM twice per month, you'll be charged $5 from Wells Fargo and an additional $4 from the ATM operators.

Over the course of one year, you'll lose $108 to banking fees.

There are fees for everything. With monthly checking account maintenance fees that range from $10-$30, $2.50 out-of-network ATM fees, 3% foreign transaction fees, and $35 overdraft fees, the fees can add up.

There are ways to opt out of some of the fees—paperless statements, minimum account balances, direct deposits, and debit card usage—but it requires commitment and time, and some customers are increasingly frustrated.

"Worst bank experiences I've ever had. There are constant monthly fees. Once they did an automatic transfer that paid my credit card off in full, which at the time I did not have enough money to do.

So without seeing it, I used my debit card on simple things ($5 or less) and got charged a $35 overdraft on about six transactions…," says Nate from Carlsbad, New Mexico in his Wells Fargo bank review.

Credit card options are lacking. If you're looking for travel rewards, frequent flyer miles, or fancy perks, you'll need to look somewhere else.

Wells Fargo offers basic credit cards (like a cash back card), but the offerings aren't particularly strong.

Interest rates for savings accounts are super low. Wells Fargo savings accounts for consumers offer an interest rate of 0.01%.

That's 0.05% less than the national average for savings accounts.

With a savings balance of $5,000, you would earn $50 in interest over the course.

But with an interest rate that matches the national average of 0.06%, you would earn $300.

That's a difference of $250 per year!

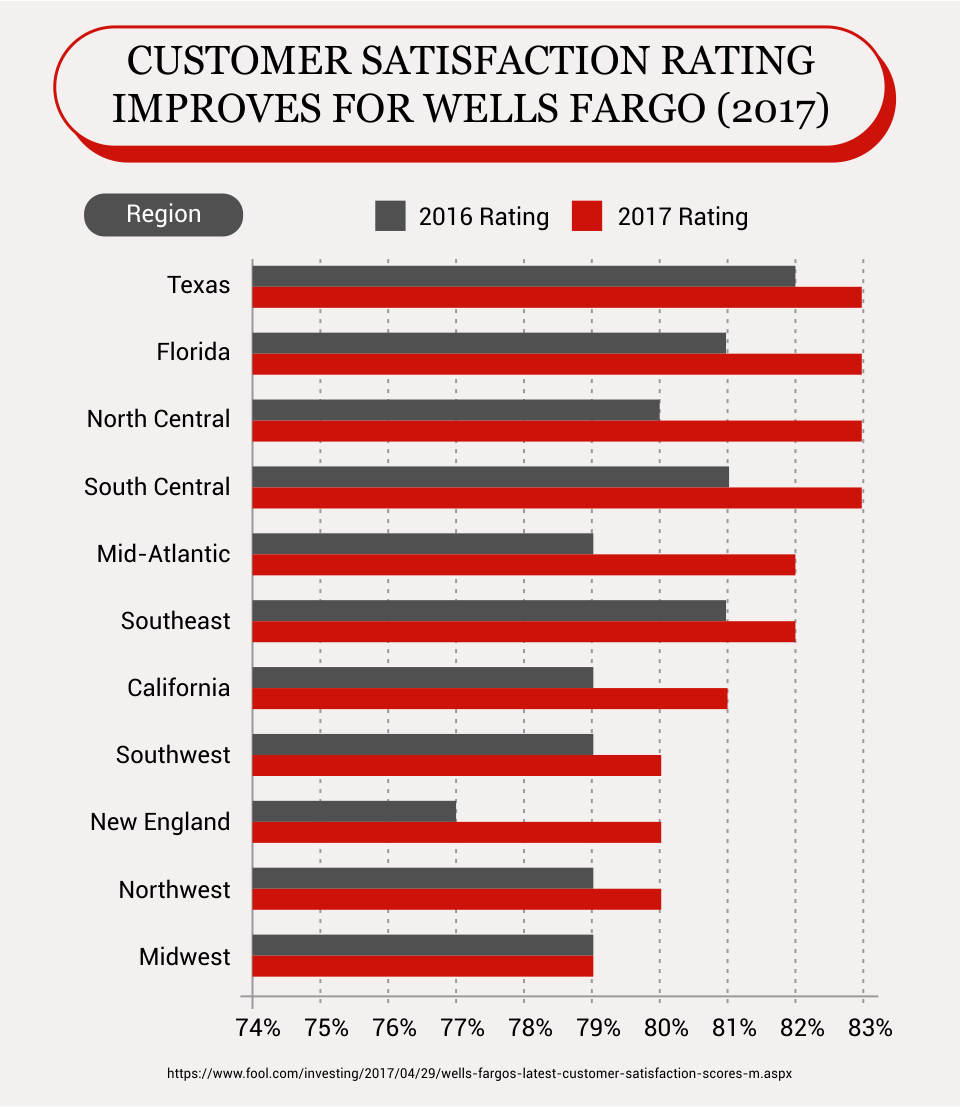

Customer service is determined by your local branch. One of the downsides of Wells Fargo's giant size is that customer experiences vary by city and state.

Some people love the service at their local branch but others hate it.

For better or for worse, in-person customer service standards are determined by local branches and according to customers, they can vary.

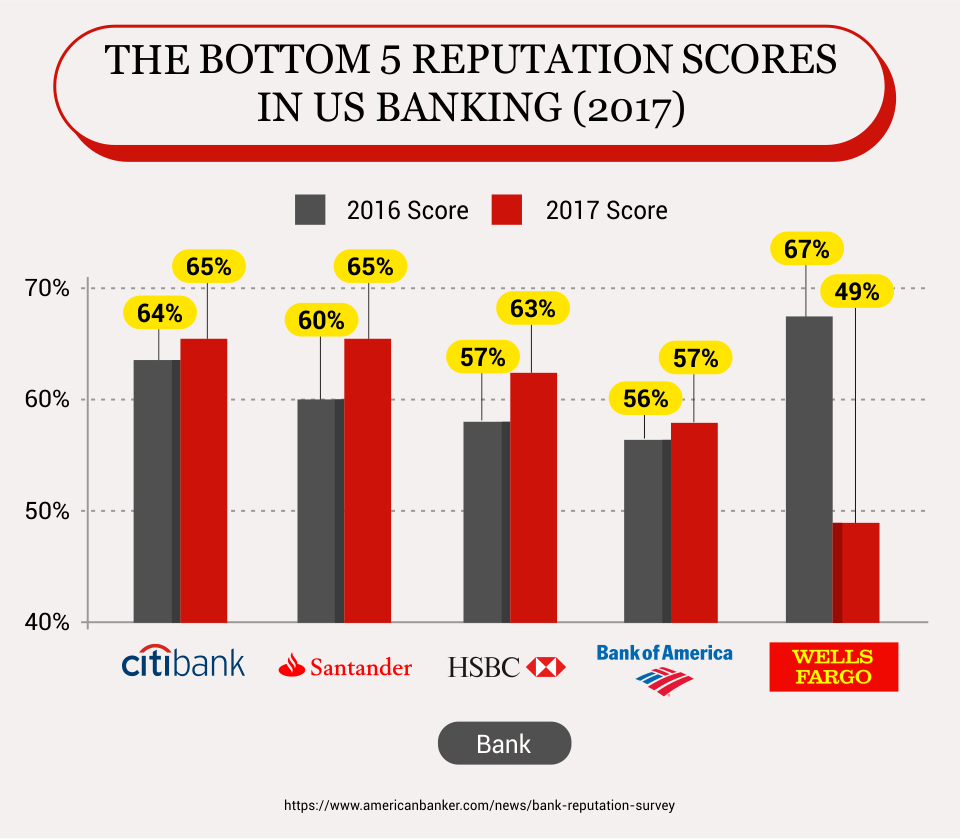

Customer service scandal. Another question you may be asking about customer service is: "Can I trust Wells Fargo after the account scandal in 2016?"

In September 2016, Wells Fargo was ordered to pay $185 million in fines to city and federal regulators for opening two million phony accounts in customers' names.

The reason the accounts were open? Unrealistic sales requirements from management. The number of new accounts opened dropped after the scandal broke, but Moody's investor service, a trusted rating firm, has agreed that the outlook for Wells Fargo is stable.

Despite the scandal, Wells Fargo continues to provide an FDIC-insured (up to $250,000) place to safely store your money and their 150+ year history is a testament that they will bounce back and make necessary changes.

The Competition

Wells Fargo competes with Chase Bank for customers and business

As the biggest bank in America, Chase Bank is Wells Fargo's biggest competitor.

Both banks are brick-and-mortar giants with all financial offerings under one roof. Here's how they compare.

Similar account options. Both Chase and Wells Fargo offer similar checking and savings accounts.

The main difference?

Wells Fargo offers second chance banking with the Opportunity Checking account for customers who have been denied accounts while Chase does not.

Chase offers more robust credit cards. Chase offers co-branded credit cards with companies like Southwest Airlines, the Ritz-Carlton, and United Airlines.

For frequent credit card users or travelers, Chase offers more opportunity to accrue rewards.

Wells Fargo has more locations but fewer ATMs. Even though both banks have robust networks, Wells Fargo has nearly 1,000 more branch locations.

However, Chase has nearly 3,000 more ATM locations.

Depending on where you live and what you need, one bank might have slightly better physical offerings than the other.

If you like Wells Fargo, then here are other competitive bank offerings to consider

Travel credit cards with American Express. With no foreign transaction fees and a generous rewards program with Delta, the Platinum Delta SkyMiles card by American Express is an excellent choice.

Citibank for excellent customer service. With over 60,000 ATMs across the country (nearly 50,000 more than Wells Fargo), Citibank wins points for increased access and excellent customer reviews.

Move online with PNC Bank. If you're ready to move to banking primarily online, PNC Bank offers wealth management and a "virtual wallet" tool that customers love, while still operating brick-and-mortar branches in 19 states.

Services Wells Fargo Offers

Checking and Savings Accounts

When it comes to your personal checking account options, Everyday Checking and Preferred Checking are similar to accounts offered by the competition. But two checking accounts stand out.

Opportunity Checking offers second-chance banking for customers who have been unable to open an account with other banks. Teen Checking allows parents to open an account for teenagers aged 13-17.

Savings account rates are standard but not horrible. Offering three different savings accounts, the main thing to note is that Wells Fargo savings interest rates are low (0.01%) compared to online banks.

Loans and Insurance

With personal loans, student loans, mortgages, auto loans and home equity lines, Wells Fargo has every loan you need.

The downside? Wells Fargo typically only accepts applications with excellent credit scores.

Interest rates for personal loans range from 6.99-23.99%, while auto loans range from 3.89-6.87%.

Student loans and mortgage rates vary by state.

Insurance is available but rates are better elsewhere. Most customers and experts agree that you can find better rates for auto, homeowner, and umbrella insurance elsewhere, but for some customers, the ease of having it all in one place is worth it.

Small Business Banking

Wells Fargo offers checking accounts, savings accounts, credit cards, and loans for small business owners.

Rates for unsecured small business loans start at 6.75% and there is a $150 upfront fee.

The most notable feature? Wells Fargo is heavily involved in the Small Business Administration's program for government-guaranteed loans.

If you want to be sure about getting approved for a loan, Wells Fargo is a great place to look.

If you already have a Wells Fargo account that has been open for a year or more, you can apply online for a loan, but if not, you must apply in-person.

There are three credit cards for small business owners.

The Business Secured card has an annual fee of $25 per card while the Business Platinum and Business Elite cards have no annual fees.

Key Digital Services

My Money Map is an all-in-one financial resource that empowers customers to track their spending, set money goals, and access free financial education resources.

For people who need day-to-day budgeting advice and spending plans, My Money Map provides a simple snapshot of all Wells Fargo finances.

My Savings Plan is a popular Wells Fargo mobile feature. It allows customers to set personalized savings goals, set up automatic transfers to their savings account, and then track their progress with colorful, easy-to-use graphs.

There are a lot of apps and websites that will help you budget and save, but the best thing about My Money Map is that it's all in one place.

There's no need to switch between apps or constantly log in and out. It's all here.

How to Find a Branch Near You

You can use their online branch locator, or download their app on Google Play and iTunes.

Wells Fargo Bank Routing Number

| Wells Fargo Routing Numbers | |

|---|---|

| State | Routing Number |

| Alabama | 062000080 |

| Alaska | 125200057 |

| Arizona | 122105278 |

| Arkansas | 111900659 |

| California | 121042882 |

| Colorado | 102000076 |

| Connecticut | 021101108 |

| Delaware | 031100869 |

| District of Columbia | 054001220 |

| Florida | 063107513 |

| Georgia | 061000227 |

| Hawaii | 121042882 |

| Idaho | 124103799 |

| Illinois | 071101307 |

| Indiana | 074900275 |

| Iowa | 073000228 |

| Kansas | 101089292 |

| Kentucky | 121042882 |

| Louisiana | 121042882 |

| Maine | 121042882 |

| Maryland | 055003201 |

| Massachusetts | 121042882 |

| Michigan | 091101455 |

| Minnesota | 091000019 |

| Mississippi | 062203751 |

| Missouri | 121042882 |

| Montana | 092905278 |

| Nebraska | 104000058 |

| Nevada | 321270742 |

| New Hampshire | 121042882 |

| New Jersey | 021200025 |

| New Mexico | 107002192 |

| New York | 026012881 |

| North Carolina | 053000219 |

| North Dakota | 091300010 |

| Ohio | 041215537 |

| Oklahoma | 121042882 |

| Oregon | 123006800 |

| Pennsylvania | 031000503 |

| Rhode Island | 121042882 |

| South Carolina | 053207766 |

| South Dakota | 091400046 |

| Tennessee | 064003768 |

| Texas | 111900659 |

| Texas – El Paso | 112000066 |

| Utah | 124002971 |

| Vermont | 121042882 |

| Virginia | 051400549 |

| Washington | 125008547 |

| West Virginia | 121042882 |

| Wisconsin | 075911988 |

| Wyoming | 102301092 |

Frequently Asked Questions (FAQ)

Wells Fargo Review Recap

Wells Fargo may not be the trendiest bank, but with branches across the country and every financial offering you could imagine, it's a reputable bank that will be able to satisfy all of your financial needs.

Do you bank with Wells Fargo?

Please let us know about any exceptional experiences (or nightmare encounters) in the comments below.