After graduation, there were times when I couldn't afford to keep up with my student loan payments.

It killed my credit score.

I didn't pay much attention to my credit rating until I got married and had kids.

When I applied for credit cards, mortgages, and insurance, I noticed I wasn't getting approved, nor was I quoted the best advertised rates.

I put two and two together and realized my low credit score was making life inconvenient and very expensive.

Fortunately, we were living where the cost of living was not super-high.

I was able to do things to improve my score, like buy a house and keep up with mortgage payments.

Where you live impacts your ability to improve or maintain a good credit score.

If you're planning to move somewhere else, you should be aware of whether or not it is a good place for someone with your credit score to live.

We're going to tell you exactly how your credit score impacts cost of living, and which areas of the US have the best credit scores.

Once you know about the relationship between locations and credit reports, you'll be able to make the right decision when it comes to choosing the ideal place to live based on your credit score.

Cost of Living

When expenses are more than income, the cost of living can threaten your credit score

Where you live has a huge impact on your budget and disposable income.

Debt inevitably occurs when your income isn't enough to cover the everyday costs of living.

If debt becomes unmanageable, late and missed payments are reported to the credit bureaus whose credit reports are used to calculate FICO scores.

Here's what we've learned about your credit score and its relationship to where you live and the cost of living.

Big cities equal big expenses. The places with the highest costs of living in the US are New York and San Francisco.

Honolulu, Boston, and Washington, D.C., round off the top five.

Avoid California unless you can afford it. The next four are all cities in California, meaning five cities in the top ten are from the Golden State.

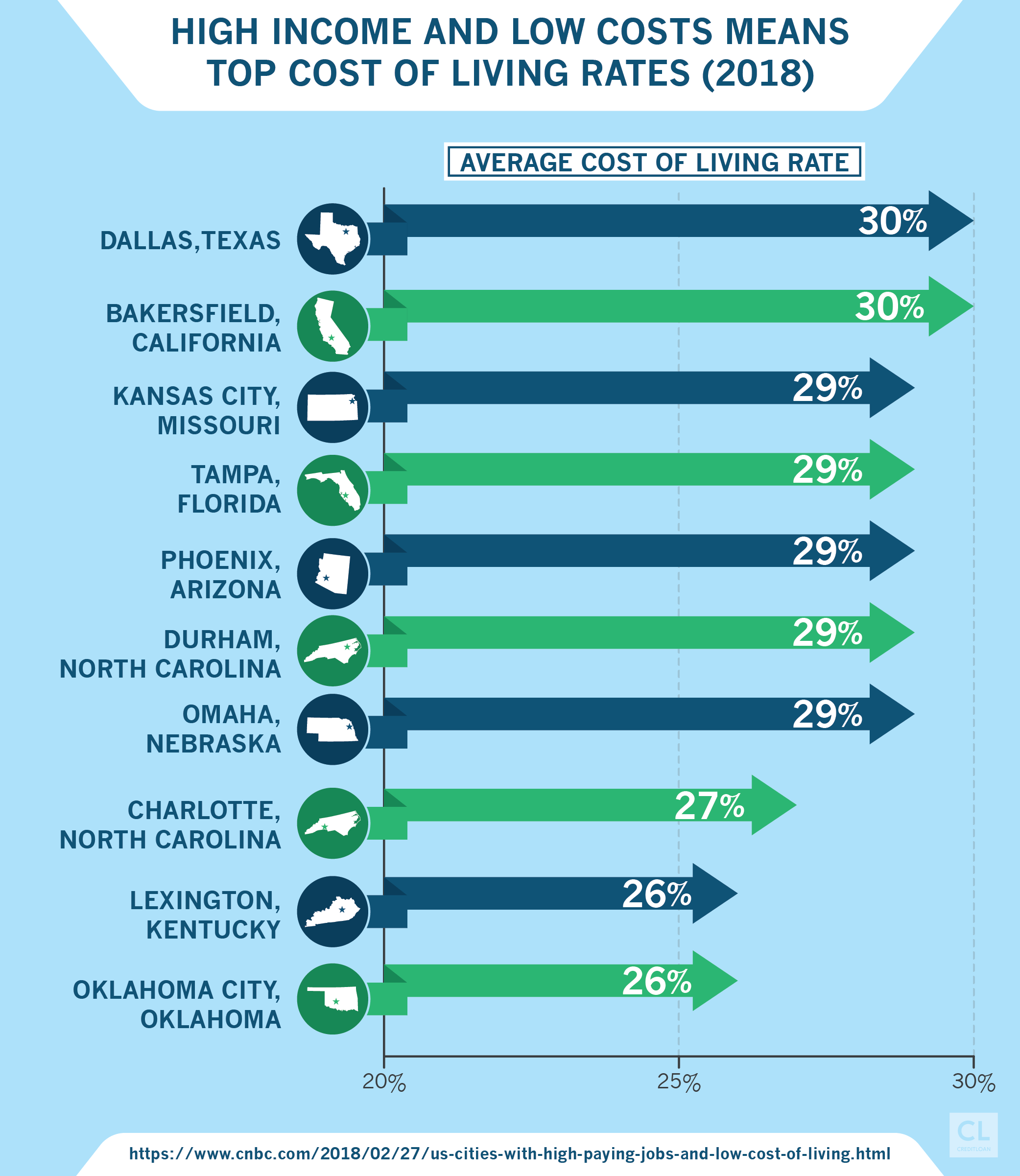

Midwest and southern states are least expensive. The top five least expensive states to live in are Alabama, Nebraska, Kansas, Indiana, and Oklahoma.

When income fails to cover costs, your credit score can get damaged

The more expensive the place where you live, the more likely you will need to approach lenders for credit.

When you can't make ends meet you have to borrow. It might start off with you being unable to cover expenses one month, so you borrow a little bit.

The next month, you'll borrow a little bit more.

Over time your balances rise.

Using too much of your available credit has a negative impact. The more of your available credit line you use and don't pay off monthly, the lower your credit score goes.

It's called "credit utilization" and it accounts for 30% of your FICO credit score.

Opening up more credit also hurts your score. New credit inquiries (usually when a potential lender runs a check on your credit report) accounts for 10% of your score.

Opening up new accounts also hurts the 15% portion of your credit score that's tied to the average age of all the credit accounts you have.

Missing payments is a credit score killer. If your balances get so high you can't keep up with minimum payments, you're likely to start being late on payments, or even missing some months altogether.

Your track record for paying back lenders on time is called your "payment history."

Payment history accounts for 35% of your credit score, so missing payments is the worst thing you can do and will quickly turn a good credit score bad.

The credit bureaus will record a black mark on your credit history, and your credit rating will take a massive hit.

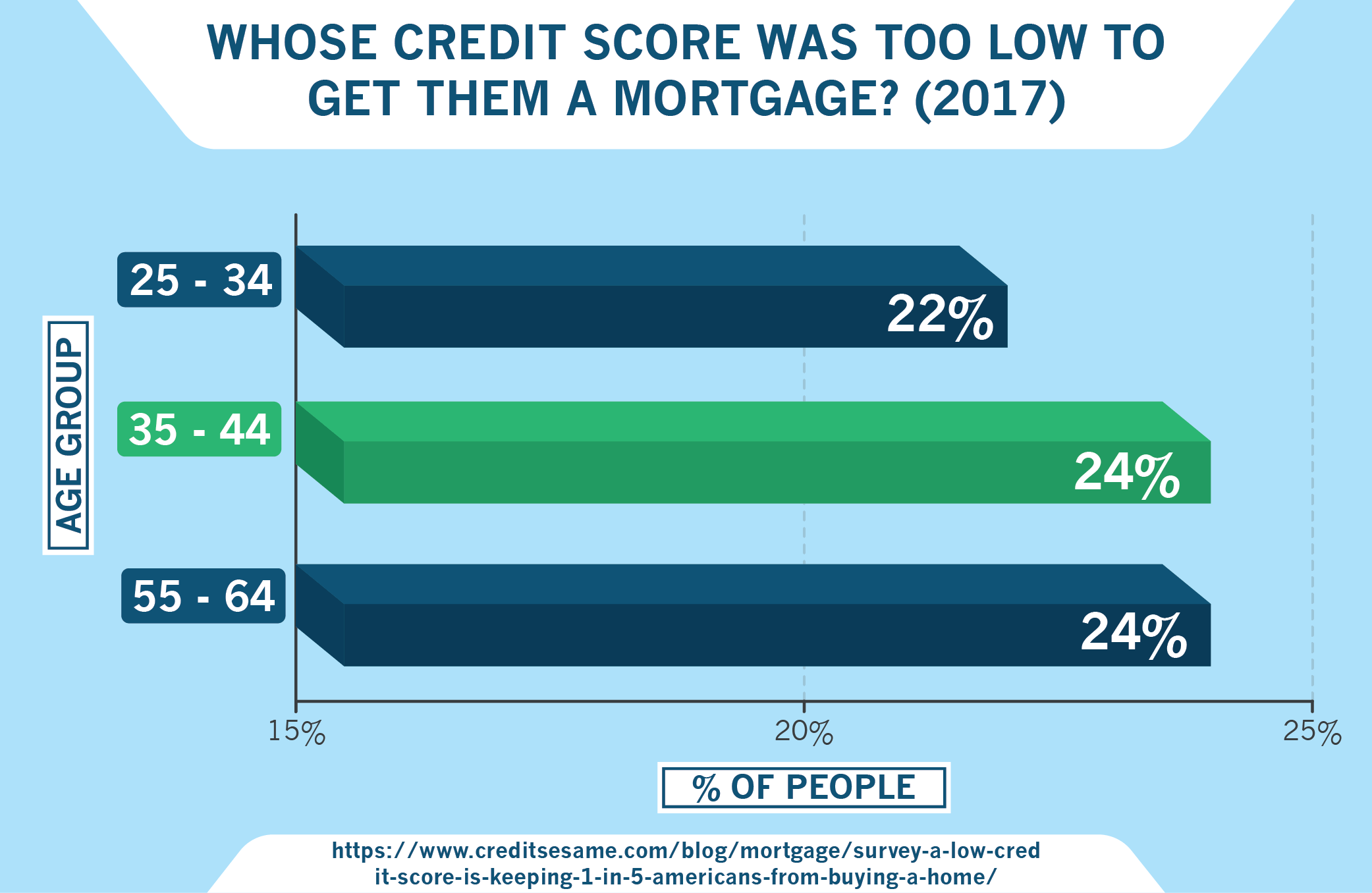

Renting instead of buying means you can't build your score. The price of housing where you live will have an impact on whether you rent or buy.

For me, living somewhere where I could afford to pay for a house and keep up with mortgage payments was a key to getting my credit score back up.

Interest Rates and Premiums

A bad credit score means you'll pay more for borrowing and insurance

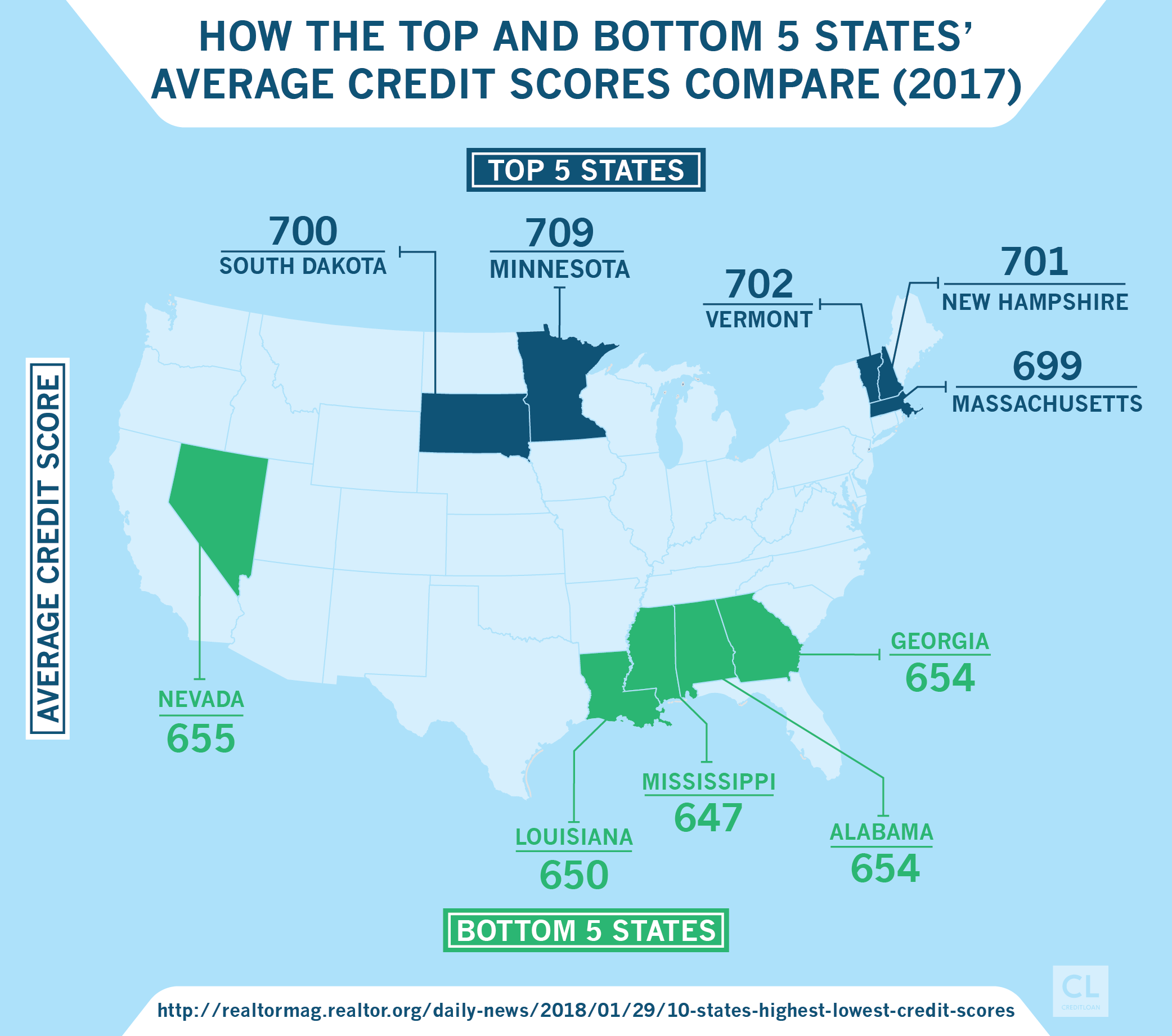

The Midwest is credit-score-friendly. The states with the highest average credit score are Minnesota (707), North Dakota (700), Wisconsin (698), South Dakota (697), and Massachusetts (694).

With four of the top five credit rating spots, the upper Midwest is clearly a region where people's expenses aren't causing them to borrow more than they can pay back.

Here's how having a high credit score can make the cost of living less expensive:

A higher credit score means a better credit card APR. The annual percentage rate (APR) a person is offered when they get a credit card is directly influenced by their credit score.

It's called risk-based pricing, where the more of a risk you are to default on a debt, the more you'll have to pay.

A person with an "Excellent" FICO score (750–850) might be offered a rate of 12.99% while someone with a "Good" score (700–750) might get 15.99%.

Making a minimum payment on a $5,000 balance for one year would cost $150 more for the person with the "Good" score.

Better credit scores get more favorable loan and mortgage terms. A less-than-perfect credit score means you'll get charged more interest if you take out a personal loan or mortgage.

Let's take, for example, a 30-year mortgage for $300,000.

Over the full term, getting charged a fixed 5% interest rate (with a "Good" credit score) would cost $64,000 more than getting charged 4% (with an "Excellent" score).

People with better credit pay lower insurance premiums. Whether it's life insurance, home insurance, or car insurance, your credit score will be checked by the insurance companies when you apply.

The return of risk-based pricing. The monthly premium insurance companies charge is higher for people with lower credit scores, the same way the credit cards charge higher APRs for people based on their FICO scores.

Credit scores influence medical coverage. Health insurance policy terms like out-of-pocket expenses and deductibles are also tied to credit scores.

Consider your credit score when choosing a place to live

You've now learned how your credit score can be impacted by the cost of living and your location.

We've also shown you how having a lower credit score can actually increase the cost of living, especially when it comes to important matters like borrowing money for a home or getting insured.

Now you need to consider a few things when choosing a place to live:

- Based on housing prices, will you need to rent or will you be able to buy?

- Will your current income sustain your expenses based on the location's cost of living?

- Do you need to improve your credit score to make living in a new location affordable?

My own life became a lot more convenient and my essential expenses became a lot more affordable when my credit score improved.

But I don't think I could have done it if I had lived in one of the more expensive cities in the US.

Where you live can actually impact your credit score, so make an assessment and see if it makes sense to stay where you are or move to a more financially-conducive location.

Since 1998, we at CreditLoan have been helping consumers learn about financial issues while providing the tools and solutions they need to effectively manage them if needed.

Hopefully, we've been able to help you assess the risks and opportunities of the areas that you want to move to.

If so, please feel free to tell us in the comments below!