The Verdict

In terms of credit monitoring services, TransUnion comes close, but is not our first pick

Like its two biggest rivals, Equifax and Experian, TransUnion is one of the three major credit bureaus and makes its money by providing data to businesses and consumers like you.

Credit monitoring is one of its signature consumer-facing products and TransUnion has tools for tracking and understanding how your spending can impact your score and how debt influences your credit.

You'll pay $19.95 monthly for these services if you sign up, but you don't have to become a subscriber to get informed about your credit.

The law allows for getting a free credit report from each of the three major bureaus — including TransUnion — once a year through annualcreditreport.com (you can also get a free report including your score through Creditloan.com).

Still interested in what TransUnion has to offer? Let's talk a little more about what you can expect from using the company's credit monitoring services.

The Competition

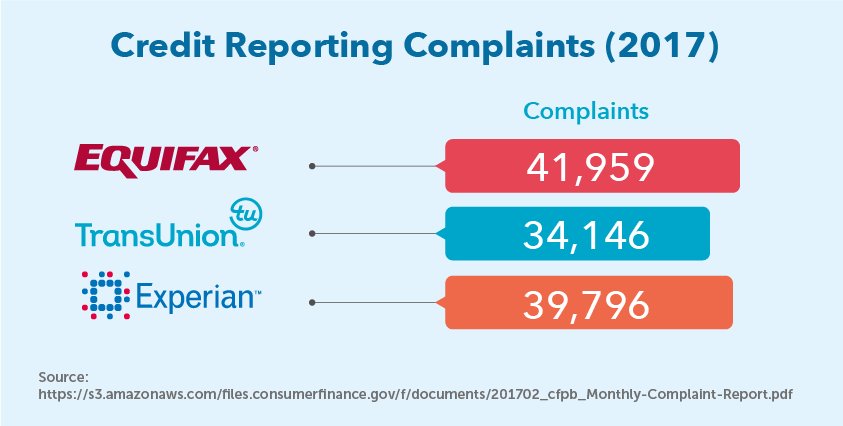

TransUnion's two biggest competitors are Equifax and Experian.

Together, these three credit-reporting agencies dominate credit scores and collectively give lenders a good picture of a potential customer's creditworthiness.

In addition to selling access to credit reports (beyond your free one entitled by law, of course) and credit scores to consumers, the big three also offer credit-monitoring products that let customers keep track of their credit history in real time and stay on top of identity theft concerns.

What's the difference between TransUnion, Equifax, and Experian?

In terms of products and other offerings, very little.

All three collect financial information on consumers that can include addresses, employment history, and any loan you've ever taken out, as well as any credit card you've opened.

The three companies use this information to create a credit score that's supposed to tell potential lenders how reliable you are when it comes to paying a debt.

Equifax offers a very similar credit monitoring product to TransUnion that matches its $19.95 price, but unlike TransUnion, it'll offer credit scores for all three bureaus.

Experian also has a similar product that's $24.99 per month after the introductory $4.99 for the first month.

Before picking a winner it's important to pause for a moment and recognize that none of the three bureaus makes available to consumers the FICO credit score that lenders see.

Instead, TransUnion and its peers provide educational scores based on their own models and using their own data.

What you see in their reports is their closest approximation to what a lender might get from Fair Isaac, the creator of the FICO credit scoring model.

All get close to approximating the FICO score. Equifax gets closest, according to reviewers, and so it deserves the top nod if you're aiming to pick a credit monitoring service based solely on accuracy and completeness of information.

TransUnion uses VantageScore rather than the FICO, which is significantly more popular.

What makes this a little confusing is that all the three major bureaus introduced VantageScore as an alternative to FICO since none of them has direct access to the FICO scoring model created and used by Fair Isaac, the creator of the FICO score.

So while it's true that TransUnion may not give you the best representation of the score lenders see when evaluating your credit, none of the big three has an "inside track."

Also, lenders report voluntarily and may not report information to all three bureaus, nor do the bureaus calculate the scores the same way.

Since the information they're working from is inconsistent, there can be variance and you may find yourself with three different (if slightly) credit scores.

Finally, while you can acquire your credit scores and reports from all three at once pretty easily, you'll have to contact each bureau individually if you want to freeze all your credit reports.

The Strengths

Nifty online tools at TransUnion can educate you about your debt and its potential impact

TransUnion offers its credit monitoring members useful resources to help in making crucial decisions about debt and spending:

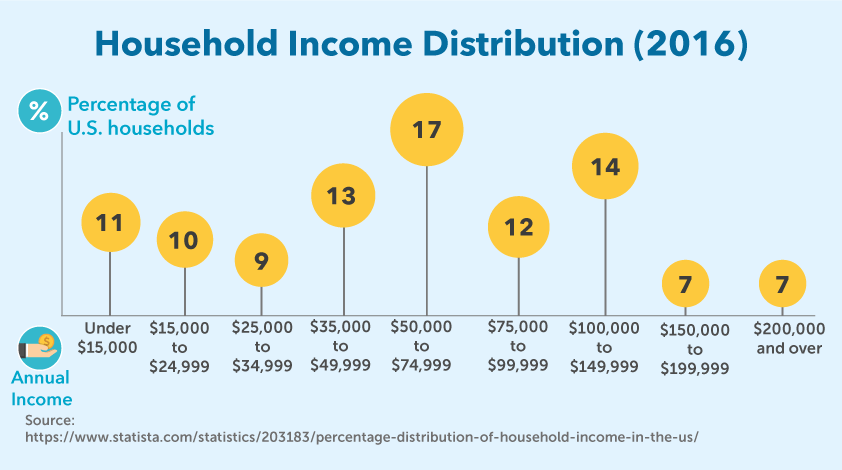

Personal Debt Analysis. You report will break down everything: how much credit you have vs. debt, and how much you pay to service that debt.

That way, you'll have insight into how lenders see the money you spend on existing debt, and how likely they'd be to extend more credit were you to ask for it.

Score Trending. Check your history to see if you've improved your credit score over time. Pro tip: compare the trend with your credit history.

That way, you'll see which payoffs or other actions had the biggest impact — actions you can replicate again and again to build your score to new heights.

Score Simulator. Log in to tinker with different scenarios and see what may happen to your credit score if you're late on a payment or pay off a credit card entirely.

Use it to plan how you'll pay back debt — or to know when to take on new debt, like for a car — so that your score is always as good as it can be given your circumstances.

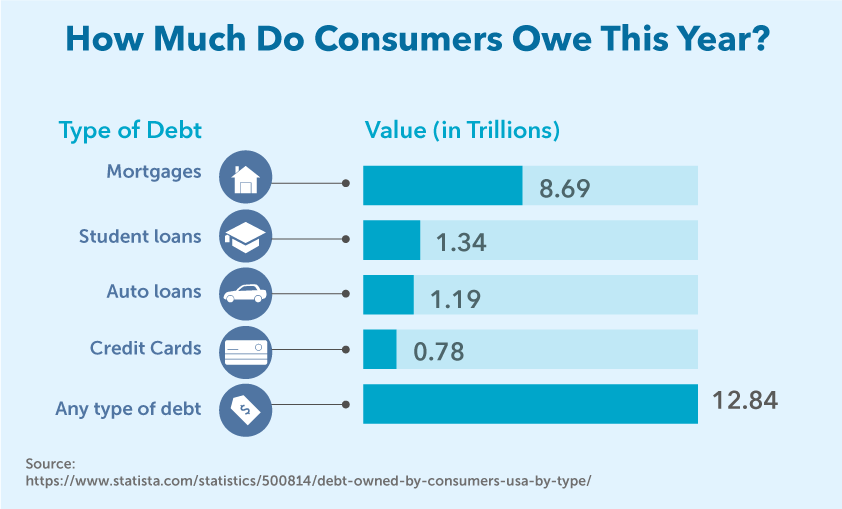

Grading your debt-to-income. Why does debt-to-income (DTI) matter?

Two reasons.

First, all creditors want to know you can afford the loan or credit card you're getting.

Second, mortgage underwriters specifically use this metric as a yardstick for approving (or declining) loan applications.

The more you know about your DTI ratio, the more prepared you'll be for the next big purchase.

These tools are also a nice and colorful ways to help visualize what you need to do better.

Just make sure the information doesn't get wasted.

One good strategy: if you're in debt and using TransUnion's tools to track progress, commit another $20 monthly on top of what you're paying for credit monitoring to paying down your credit cards and other loans.

The Weaknesses

Lack of popular FICO score and single-bureau reporting severely limits TransUnion's value

The report is limited to how TransUnion values and weighs data for their scoring model, and TransUnion uses VantageScore.

That would be a bigger problem if Equifax and Experian both used FICO, but they don't.

Instead, all three have their own models aimed at closely approximating FICO since only myFICO — which is owned by Fair Isaac — has access to the actual FICO scores lenders see and use when making credit decisions. All three are also contributors to VantageScore.

The trouble with single-bureau reporting. If there's a major weakness here it's that TransUnion's reporting is confined to changes in its own report on you.

Changes in your Equifax and Experian reports would go unnoticed and therefore unaddressed, not exactly what you'd want when aiming to monitor your credit.

Limited lock and freeze. Also, many of the services they provide, like alerting you to changes and the ability to lock, freeze, and lift your credit report, are usually limited to just that bureau's report.

Can't easily dispute an error online. Equifax and Experian, on the other hand, both allow you to dispute information with a mere click on their website.

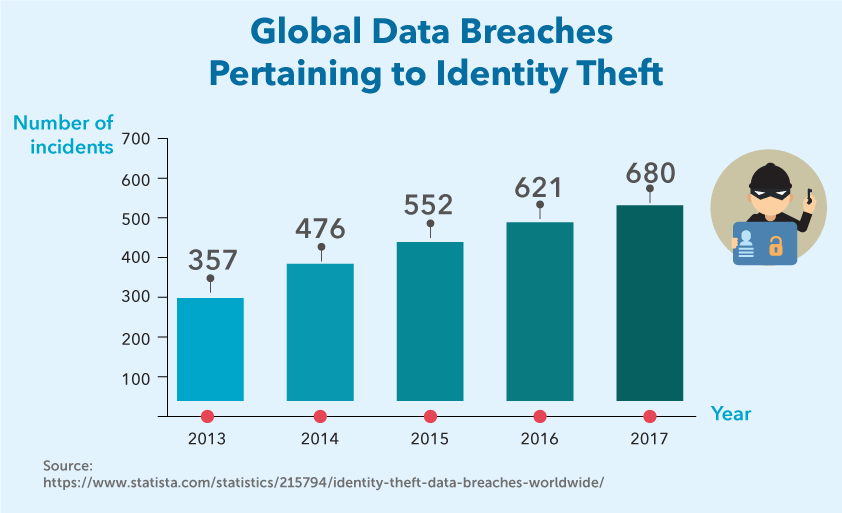

Finally, remember that credit monitoring is a tool to help fight identity fraud — and would only be able to notify you after the theft has happened and the thief attempted to use your credit.

Why You Need This Service

TransUnion is for those specifically interested in their TransUnion-only VantageScore

It's hard to recommend an ideal user for TransUnion Credit Monitoring, at least one who would find it useful enough to pay $19.95 for it every month.

But while it's very difficult to know which lenders are reporting to which bureau, it may be possible to suss out which ones from third-party anecdotes.

Our friends at First Quarter Finance came up with a list of credit cards that reportedly only report to TransUnion.

If you're interested in a credit card from Barclay, or a Capital One BuyPower card that can earn points toward the purchase of a Cadillac, Chevrolet, Buick, or GMC vehicle, it's possible you may be especially curious about your TransUnion credit report and want to follow it more closely than Equifax and Experian.

But please keep in mind that this is merely a very educated guess based on secondhand research, and there are no guarantees that any lender will only pull your TransUnion report.

About the Company

From leasing trains to leasing data: A short history of TransUnion

If TransUnion doesn't sound like the name of a company that deals in credit services, that's because it began corporate life as a holding company for Union Tank Car Company, a railroad leasing organization.

A year after forming in 1968, they expanded and bought the Credit Bureau of Cook County and its 3.6 million file cards of consumer credit information.

Their collection of data only grew from there and by 1988, they had details on just about every consumer in the United States.

TransUnion continued to expand and became a public company in 2015, and are firmly entrenched as one of the three major credit reporting bureaus that lenders and borrowers rely on.

What the Company Does

Reading, understanding, and disputing inaccuracies on your TransUnion credit report

TransUnion and other credit reporting agencies make their money by charging vendors for access to your credit history and then providing tools for deeper insight.

If you would like to do more than merely access to your credit history — monitor it, like credit card companies can do, for example — you'll have to pay.

Otherwise, getting your report for free at annualcreditreport.com is the better bet.

But let's say you want more.

Here's what you get…

Your TransUnion credit will break down your credit history by account, giving you details like amount of the loan or credit line, your monthly payment, and whether or not you've made those payments on time.

Your perks of being a member include:

View your debt-to-income ratio and build a better budget. While you can simply calculate this on your own — take your total monthly payments to debt and divide by your monthly income — TransUnion gives you a rating that lets you know where you stand.

For instance, using 40% of your income to pay debt would be considered within the range to qualify for a mortgage.

Access your VantageScore credit score as often as you'd like. You'll be able to access your TransUnion credit report and credit score, with unlimited refreshing so you can see changes as they happen.

Monitor for fraud by setting up instant alerts. While signing up for TransUnion credit monitoring won't provide you access to your Equifax and Experian data, the trio cooperate often to give lenders the best information possible.

Accordingly, TransUnion can advocate for members by watching for changes at the other two major bureaus.

You'll be instantly alerted to any suspicious activity, like when someone applies for a credit card in your name.

Use educational tools. Online resources like Score Simulator, Personalized Debt Analysis, and Score Trending can help put your debt and spending habits in perspective.

Activate identity theft protection. TransUnion offers the standard $1,000,000 in theft insurance that Equifax and Experian also offer, as well as access to ID theft specialists in case you run into fraud concerns.

You'll also be able to lock and unlock your TransUnion credit report.

Cancel online anytime. Believe it or not, this is a very useful feature that Equifax does not offer. TransUnion and Experian both allow you to cancel online.

Fees and costs you'll need to keep in mind

The cost for TransUnion's credit monitoring service is $19.95 per month.

If you've already purchased a free credit report under the Federal Fair Credit Reporting Act (FCRA) or the Federal Fair and Accurate Credit Transactions Act (FACT) in the last year, you could still be eligible for another one under certain state laws.

Price for reports can vary by state.

You may also have to pay for additional requests, which can vary from $1 to $11.50 depending on the state.

Check out their table on the TransUnion site.

If you'd like to access your Equifax and Experian credit reports and scores through TransUnion, it'll cost an additional $29.95, a one-time cost that you'll have to pay each time you'd like an update.

Fine print you should watch out for

When reviewing any language by TransUnion, note whether you're being offered a credit report or a credit score.

These are two different products.

While you're entitled to a free credit report once a year from the three bureaus, this does not include your credit score.

Think of your credit report like you would a driving record: its history.

The credit score is a number based on that history and includes the tickets and length of time you've been driving and other factors: it's a rating.

A creditor needs both to make a proper judgment when lending to you, but it's the score that does the work of determining whether you're truly creditworthy.

Also, there's a weird limitation to the "unlimited" access to your report that TransUnion advertises.

While you can refresh the credit report and score you see online, you won't be able to view any actual changes more than once a day.

What People Love

TransUnion members benefit from around the clock access… otherwise, raves are tough to find

With a very limited menu of products and services that offer very limited tangible value to consumers as well as stiff competition from two other major players, it's tough to find ringing endorsements for TransUnion.

The few good ratings you'll find on consumer review sites are from folks who either compliment an individual customer service representative or are so concerned about identity theft that the fee is worth their peace of mind.

Many of the popular money sites struggle to find superlatives in their reviews of TransUnion's credit monitoring services, giving the impression that there's almost no enthusiasm for the product.

Even sponsored reviews like Debt Roundup can't find much to compliment, except for liking the email alerts TransUnion will send when credit inquiries are made in your name.

But it's not all dire.

A sponsored post at MoneyUnder30.com rightly points out that having 24/7 access to your latest credit score can be a nice benefit if you're "working toward a credit score target prior to applying for an auto loan or mortgage."

If you're dying to know your VantageScore (the only score TransUnion offers), then you're probably better off paying the one-time fee of $29.95 that gets you a credit report and credit score from all three bureaus.

Biggest Consumer Complaints

Allegations of deception and unauthorized billing are the biggest consumer complaints about TransUnion

Unfortunately, the love for TransUnion is almost unanimously zero on Consumer Affairs.

Let the buyer beware. Many people report being lured by promises of a free credit score, unwittingly signing up for a subscription, and being billed every month – with much difficulty chasing down a refund.

In fact, in January 2017, TransUnion was ordered by the Consumer Finance Protection Bureau to pay almost $20M in fines and restitution for misleading customers.

Over at Consumer Affairs, Shannon in Phoenixville astutely points out that Unlimited Refresh isn't actually "unlimited" at all. It's daily.

Unhelpful and strong-armed customer service. In addition to customer service representatives not being able to explain a sudden change in one's credit score, many callers report being pressured into paying if they want to learn more.

While it may be expected that dealing with a credit bureau is about as pleasant as the DMV or post office, the consumer frustration with TransUnion seems to be a different breed.

Key Digital Services

Disputing inaccuracies on the TransUnion website is not as easy as just accessing your free credit report

If you're performing a review of your free annual credit report from TransUnion and you'd like to dispute an incorrect detail, it's not as simple as clicking a button.

You'll have to sign into your TransUnion account, and that means creating one if you don't already have one.

Of course, being a member of TransUnion's credit monitoring service skips this step but those taking advantage of the free credit report will have to jump through the hoops of creating and keeping track of yet another username and password.

Equifax and Experian, on the other hand, both allow you to dispute information with a mere click on their website.

TransUnion app includes on-the-go identity protection. TransUnion provides an app whether you have an Android or an iPhone, but what can the app do that the website can't?

If you're paying for their credit monitoring service it's probably because you find it occasionally useful to access your credit report from your phone.

You may also want the ability to lock and unlock your credit report when you're away from your desktop computer.

Instant alerts to notify you of suspicious activity. Instead of waiting for an email, you can be immediately notified whenever there's a noteworthy change to your credit report as if you're receiving a text from a friend.

Credit Lock Plus controls your credit report from your phone. Whether you're out and about shopping for the perfect lender or if you just prefer to do everything from your phone, you can lock and unlock your credit report using the TransUnion app.

This feature includes the ability to lock your Equifax report as well.

However, it doesn't control your Experian report, and not worth paying for if you're not concerned about people opening accounts in your name.

How to Sign Up

Go to the TransUnion website to sign up for credit monitoring

You'll have to create an account with TransUnion and be ready to verify your identity with your full name, address, birthdate, and your Social Security number.

Note that this is different than getting a free report — not a free credit score, just your report — from TransUnion, which you can get if you're unemployed or on assistance, believe you have been a victim of fraud, or live in one of the following states or territories: California, Colorado, Connecticut, Georgia, Maine, Maryland, Massachusetts, Minnesota, Michigan, Mississippi, Montana, New Jersey, Puerto Rico, Vermont, or the U.S. Virgin Islands.

If you're ineligible for a free report but still want access TransUnion will ask security questions about your financial history before giving you access to your report.

You'll also need to have your credit card ready for payment.

How to Cancel

You'll have to call to cancel your recurring TransUnion charges

To close your account, call TransUnion over the phone at (855) 681-3196, Mon-Thurs: 8am-midnight EST, and Fri-Sun: 8am-8pm EST.

Keep thorough, dated records when you cancel over the phone.

Verify the info when you cancel. Be sure to get the cancellation confirmation number and the name of the person you talked to.

FAQ

You should absolutely be consulting your TransUnion credit report at least once a year with your free credit report through annualcreditreport.com, but when it comes to actually paying for this information, make sure you're paying for what you need.

Only folks who want to be vigilant about protecting themselves from identity theft and those willing to gamble on a prospective lender only pulling a TransUnion report will be interested in this service.

Do you use TransUnion credit monitoring?

How has the service worked out for you?

If you have any great tips (or nightmares) to share with the rest of us, let us know in the comments below.