Mortgage refinancing is when a homeowner seeks new a loan that enables them to pay a lower rate on the money they originally borrowed to buy their home.

The savings, can be substantial.

After all, your mortgage is likely the biggest single expense you'll ever have, so even a minor change can make a massive difference to your lifetime savings.

For instance, most of us are thrilled if we can knock 10% off our monthly phone bill, for instance, especially since most of us spend almost $1,000 a year cell services.

Now imagine doing the same thing and saving thousands of dollars by refinancing your mortgage.

But many homeowners today don't take advantage of the savings.

In fact, a National Bureau of Economic Research study found that 20% of American households with fixed-rate mortgages could and should have refinanced in 2010—but didn't.

Of these people, the median homeowner could have saved over $45,000 in payments over the lifetime of the loan.

Not knowing what a refinance is, how much it can save you, and how much it'll cost can make a severe and unnecessary dent in your bank account.

You'll spend a lot of extra years paying off your home if you don't while missing out on the benefits of refinancing.

Reasons to Consider Refinancing

First thing's first: If your current mortgage payment is higher than 28-33% of your income, the red flag should already be waving in front of you.

No one wants to be "house poor"—that sticky scenario when you have lots of house, but not much money leftover to enjoy it (or anything else).

Refinancing your mortgage can free up access to cash you've earned

Refinancing your mortgage enables you to lower your monthly payments and/or grant you access to the equity you've built up in your home to make cash available for other things like home renovations, college tuition, or retirement savings.

Who doesn't like to have more cash to spend, especially if it's cash that was going to go to the bank?

This all sounds great, we know, especially if you or your better half have his/her heart set on saving money or finally getting that a new, updated kitchen.

So if you're ready to get started, here's what you need to know to decide if you should refinance your mortgage, and how to do it the right way.

Understanding Your Options

Simply put, refinancing your mortgage means paying off your existing loan with a new loan that has a lower interest rate.

That is, you actually have a choice when it comes to the paying off your mortgage.

You don't have to settle for the first one you took out.

If interest rates have fallen since you got your initial home loan, or if your credit score has improved enough that you might be eligible for a lower rate, you could potentially save a lot of money on your monthly payment.

Translation: A more affordable solution to paying off your mortgage may exist!

Consider these three ways to pay less money for your mortgage via mortgage refinancing:

Pay your loan off with a loan that has a lower interest rate.

You'll save money on each month's payment, because you're paying less interest.

On a $200,000 loan, for example, lowering your rate from 6% to 5.5% would mean saving $63 per month, or $7,560 over 10 years. Not too shabby!

Move to a different mortgage term.

As the Fed points out, you could decide to build equity faster by switching from a 30-year mortgage to a 15-year loan, for example.

On a 15-year loan, your monthly payments will be higher, because you're paying back more of the principal each month.

But because you pay the loan off more quickly you'll pay much less in total interest over the life of the loan.

Plus, a shorter loan typically has a lower interest rate.

If you borrow $200,000 in a 30-year loan at 6%, your monthly payment will be $1,199 and your total interest payments will be $231,640.

In a 15-year loan at 5.5%, your monthly payment increases to $1,634, but your total interest payments will be only $94,120—less than half the original!

Switch from an adjustable-rate mortgage to one with a fixed rate.

An adjustable-rate mortgage typically starts with a lower rate than a fixed-rate loan, but after a certain number of years the interest rate starts shifting, and you never know where rates might go.

Fixed-rate loans will likely come with a slightly higher interest rate, but that rate will never change, giving you predictability.

If you have two mortgages, refinancing is a chance to combine them into one.

Besides possibly saving money due to lower interest rates or your better-than-before credit score, for example, you can simplify how you manage your finances each month.

Even if the savings turn out to be very small, the stress you'll avoid by only dealing with one lender may be worth the effort.

Smart minds know that "knowledge is power."

The more you know what is mortgage refinancing and what are your options to pay off your home loan, the better equipped you'll be to see if pursuing one makes financial sense.

Check to see if Penalties Exist

No one likes to lose money, especially banks.

When you refinance your mortgage, there may be a prepayment penalty on your existing mortgage that you need to be aware of, since most banks need to ensure they're still "making bank" on the loan they originally extended your way.

There are two types, a soft and hard penalty:

Asoft mortgage pre-penaltydoesn't penalize you if you sell the home. It only gets you if you seek new mortgage refinancing.

A hard one penalizes you if you sell your home— that is, if you prepay the entire value of the original mortgage with the money made from a sale and choose to refinance your mortgage with someone else.

The hard penalty is what you want to avoid.

Some of these penalties require paying up to 80% of six of your current monthly mortgage payments!!!

Here's an example of how expensive a mortgage prepayment penalty can be:

Let's say the original loan amount was for $500,000

The interest rate is 6.5%

The monthly mortgage payment is $1,354.17

6 monthly payments = $8,125

80% of those 6 monthly payments = $6,500

In this case, it's likely that a person refinancing their mortgage by taking out a new mortgage to pay off the old one would actually be paying more because of fees.

Inquiring about fees up front and then running the numbers, if a fee exists, is a must-do when it comes to working your way through the mortgage refinance consideration process.

If a fee exists, then read your contract carefully and understand that you'll need to start a polite conversation with the lender about your options.

It's not impossible that your lender will support your efforts to refinance, as long as you enter the conversation informed about your options and ready to compromise.

Figure Out How Much a New Mortgage Will Cost

As we know, nothing in this life is free.

And because refinancing your mortgage means taking out a new loan, you'll have to pay most of the same closing costs that you paid for your initial mortgage.

That means, things like origination fees, title searches, appraisal fees, and lawyer's' fees all need to be factored into your mortgage refinance plan.

These fees could run up to 3-6% of your outstanding loan balance, according to the Federal Reserve.

The real estate site Zillow calculated that closing costs on a home average $3,700.

That big chunk of money may make refinancing your mortgage not worth the effort—or, it may pale in comparison to what you'll save on a mondo loan.

Your goal is to know what that number is.

Read the Fine Print!

Sometimes, mortgage refinancing fees might be rolled up into a new mortgage, meaning you pay little or nothing at closing but the balance on your mortgage increases to cover the costs.

It's important to be careful with loans that sound too good to be true.

In cases like this, you'll be paying interest for the life of your loan on those closing costs, reducing the savings you're getting from your refinance.

Deciding whether to refinance your mortgage is really just a simple math problem:

Add up the amount possibly saved on a new loan versus what you're paying now.

What would your monthly payment on that new loan (plus closing fees) be versus the monthly payment on your old loan?

Online loan calculators and comparison tools like Creditloan's refinance mortgage calculator are specifically designed to help you determine if one makes financial sense for you.

Are the savings enough to outweigh the costs?

If so, then what are you waiting for?

Shop Around for a New Mortgage

There may be better interest rates offered by banks other than the one that holds your existing mortgage.

Again, you're not locked into using your original bank to pay off your initial home loan.

But before put on your "smart shopper" hat (yes, you're shopping for a mortgage), and get to work, you should first verify that you've done everything you can to get your credit score as high as you can.

The higher the score, the better mortgage refinancing options you'll receive from various lenders.

Armed with your best credit score possible, get to work looking for new lenders.

Online tools like Creditloan's can easily help point you in the right direction.

- Pro-tip: Shop around, but don't overlook your original loan provider. You can re-approach them for refinancing, too. Your current lender may also be able to waive some closing costs, because they already have things like inspection reports and insurance certificates on file for home.

Besides shopping around and verifying that interesting mortgage refinancing options exist, and that interest rates are low, consider if a switch right now is best for you and your family.

Who Shouldn't Refinance

You probably shouldn't seek mortgage refinancing if:

- You're likely to be moving soon. It takes some time for your lower monthly payments to offset the new closing costs, and it's not worth doing unless the savings cover your expenses.

- You've held your current loan for a very long time. The way amortization tables work (those detail each periodic payment on a debt you pay over time) is that you start off your loan paying mostly interest and not a lot of the principal. By the end of your mortgage term, you're paying down mostly the principal and not a lot on the interest. A new loan would put you back to paying mostly on the interest again, meaning you'll slow down how much equity you're building.

- You're 10 years into a 30-year mortgage and refinance with a new 30-year mortgage. In this case, you'll end up paying off that loan for 40 years. For many people, that's no concern as long as the savings are there. But others may like to see light closer rather than at the long end of the tunnel.

- The savings you discover you'll get from online calculators like Creditloan's shows a negligible amount of value. Getting a new mortgage doesn't happen overnight. Just think back to all the original work that went into closing your original mortgage—shopping for rates, filling out paperwork, showing financial records, and attending a closing. You will need to go through all of that again should you choose to refinance your mortgage. If the savings amount is minor, double check the math to prove that the grunt work that'll go into mortgage refinancing will pay off in the end.

Don't Be Intimidated by the Refinancing Process

The finance industry can make refinancing a mortgage seem a bit confusing and paperwork intense.

They know that when you're intimidated by long forms and numbers, you're less likely to be assertive and take charge of your money.

To supercharge your brain, do this: Slow down. Don't rush the process.

Taking weeks to decide how/if to proceed is perfectly reasonable.

Remember that every decision you make about refinancing your mortgage should be based almost entirely on whether you'll save more money that what you're currently paying.

You'll find that you'll welcome the process of paperwork and number-crunching when all the calculations come out in your favor.

Don't guess or assume.

Check if refinancing your mortgage makes financial sense.

Is it worth it to refinance your mortgage?

That's up to you and the options available based on your financial circumstances.

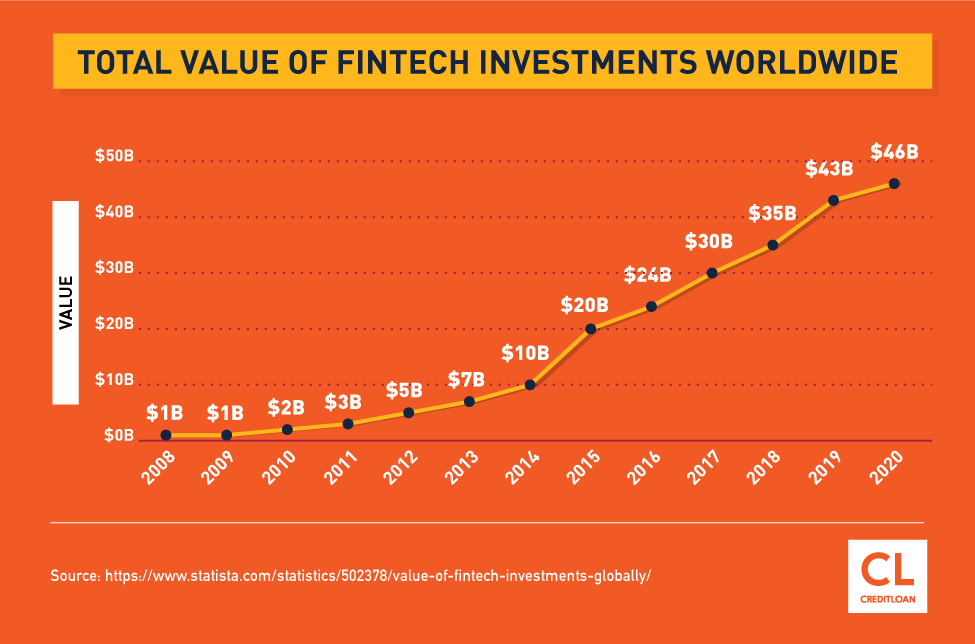

What's important to note now is that "yes," interest rates are starting to climb after a long slumber.

While those rates have been sleeping, financial technology or "fintech" has made mortgage refinancing much easier with online loan calculators and analysis tools.

Plus, there is a multitude of banks willing to explore the option with you.

When it comes to monthly payments on one of your biggest lifetime expenditures, you don't want to mess around.

Not knowing your options—or being afraid to ask—is no longer acceptable.

The savings you can realize (if you've followed this guide and confirmed that a new mortgage loan is right for you) are just too massive to miss!

Armed with this new knowledge about the ins and outs of mortgage refinancing and how it works, you'll know a good deal the second you see it.

Home owners that have refinanced their mortgage, what has (and hasn't) worked for you?

Was it worth it?