As a prominent online lender, Avant is known for catering to customers with below-average credit looking for a personal loan.

About Avant Loans

Avant is an online personal loan supplier that prides itself on providing a simple process that is easy to pay back and caters to those whose credit is not good enough to get a prime loan.

Avant has provided loans to more than 500,000 borrowers, and offers equal monthly payments, no prepayment fees and late fee forgiveness.

Part of Avant's appeal is their online rate check tool which allows you to see what your personal rate would be without dinging your credit score.

That transparency has been well-received by customers.

Avant operates in every U.S. state except for Colorado, Iowa and West Virginia.

Avant's Services

Avant offers personal unsecured loans from $1,000 to $35,000.

All loans are secured at a fixed rate for 12-60 month terms, with no prepayment penalty and a late payment forgiveness program.

Avant also reports repayments to the Credit Bureau so it makes a great option for those looking to build or rebuild their credit.

Types of Loans

Consolidation Loans:

Used to pay off multiple debts in one monthly payment

Home Improvement Loans:

Used to remodel, repair or build additions to a house including buying furniture, home security systems, kitchen appliances, finishing a basement or landscaping

Emergency Loans:

Home and Auto Repairs, including roof damage and burst or leaking water pipes

Vehicle Repairs, including labor, repairing or replacing parts

Medical or Health Bills: Medical treatments, procedure or medication

Other Expenses:

Vacations

Lost Valuables including technology that has been lost or stolen

Avant's Terms of Service

- The minimum loan offered by Avant is $1,000 and the maximum is $35,000.

- Terms of the loans are from 12-60 months.

- The interest rates run from 9/95% to 36%, and the origination fees are between .95% to 3.75%.

- There are no prepayment penalties (meaning it does not cost you more if you pay off your loan earlier than the agreed term), and they also offer some late payment forgiveness.

- Fees may vary state-to-state.

Late Fees

Avant offers a late payment forgiveness program in which a borrower is charged $25 if their monthly payment is over 10 days late.

However, if the borrower pays the next three payments on time, Avant will refund the $25.

Avant also encourages customers to contact them if they are having difficulty paying their loan.

They may be able to adjust the monthly due date.

Loan Eligibility

Avant will work with borrowers to try and find an individualized loan suitable to their needs, but the average customer has a credit score around 600-700, and have an annual income in the $40,000 range.

Eligibility is also based on other factors including credit check, employment and loan repayment history.

Borrowers can check their loan rates by entering their information into the "Check Your Rate" tool on the Avant website before applying so they can decide whether or not to apply without affecting their credit score.

Avant will, however, check their credit score after they have submitted their application.

Application Process

Avant's online application is quick and easy two-step process, taking about five minutes.

The form is self-explanatory and clearly indicated all applicant documentation required.

If an applicant is approved, they can expect to receive funds the next day.

-

The "Check Your Rate" Tool

In order to check your rate online, you must create an Avant password-protected account. You will be required to submit the following information to create your account:

- Name

- Contact information

- Password

- Income type

- Social security number

- Monthly net income

-

Review Your Loan Options

After submitting the information in the "Check Your Rate" tool, you will be immediately presented with the loan options available to you. Review your options and if they are suitable, complete the form with your electronic signature.

-

Standard Verification Process

All applicants are required to verify their identity and Avant provides an electronic knowledge-based authentication (KBA) tool to achieve this efficiently. The KBA asks applicants a number of individualized questions to verify information like employment and bank account details.

-

Additional Verification Process

Some applicants maybe asked to provide further confirmation through documentation. In this case, a representative from the Avant Originations team will make contact to complete the verification process.

-

Submitting Documents

An Avant Originations team member may request copies of documentation, like bank statements or pay stubs, which can be uploaded to your dashboard, emailed to apply@avant.com or faxed to 866.625.0930.

Avant Loan's Ratings

- Better Business Bureau rating: A+

- NextAdvisor: 4.5 out of 5 stars

- LendingTree: 4.6 out of 5 stars

- SuperMoney: 4 out of 5 stars

- Consumer Reviews: 1.5 out of 5 stars

- NerdWallet: 4 out of 5 stars

- BestCompany: 7.1 out of 10

- TopTenReviews: 8.95 out of 10

Avant's User Friendliness

Avant's "Check My Rate" tool provides an algorithm that customizes rates easily for customers they can see their loan options without it affecting their credit score.

This transparency is extremely useful for applicants.

Avant use of the electronic knowledge-based authentication (KBA) tool provides straight-forward verification from the convenience of home

The application process is very smooth and takes about five minutes.

After approval, funds can be released by the next day.

Avant Mobile App

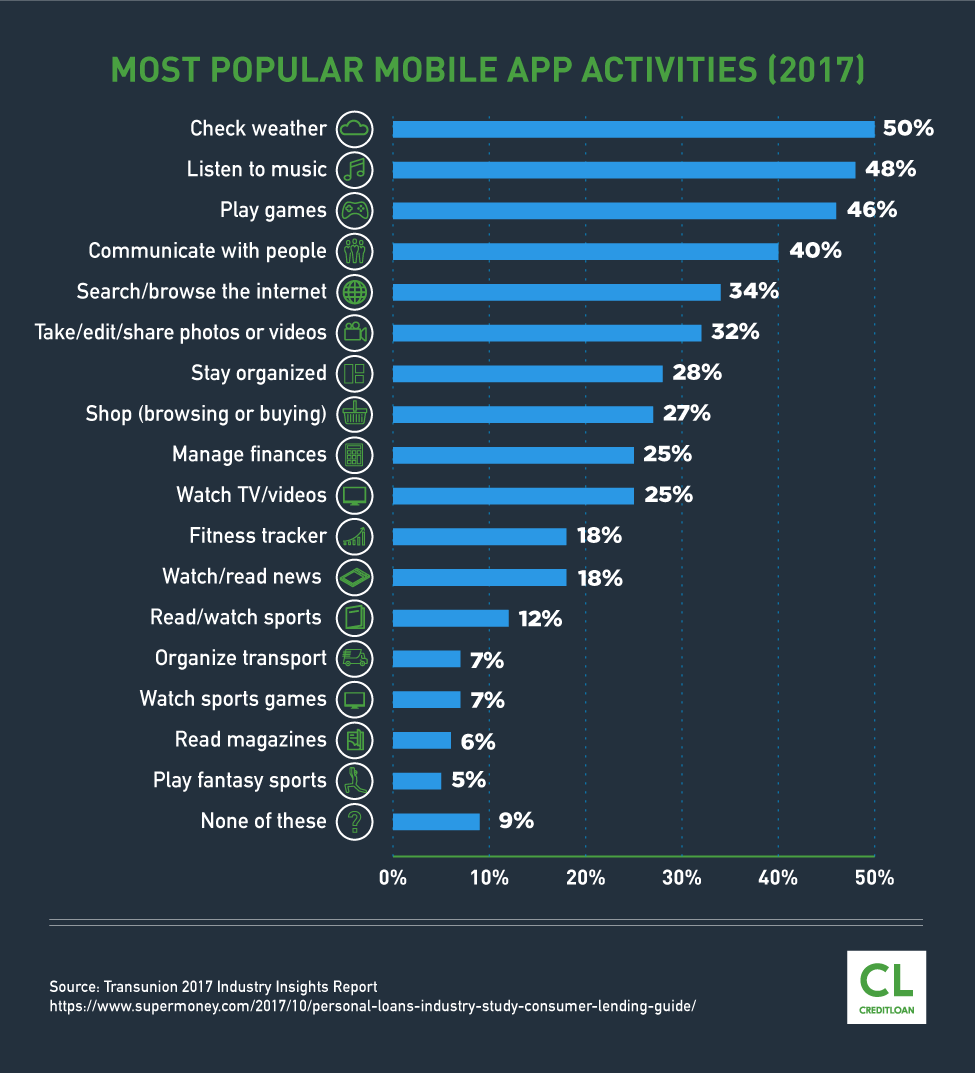

Avant also offers an app that allows customers to manage their loans through their device, including payments and push notifications.

Customer Service

Avant has consistently rated high on their customer service.

They seem to offer a positive corporate culture which is reflected in the knowledge, courtesy and effective customer service staff.

Customer service is available seven days a week by phone (800.7112.5407).

The hours of operation are Monday to Friday, 7am to 10pm, Central time, and Saturday to Sunday, 7am to 8pm, Central time.

Customers can also contact support by email at support@avant.com or chat live with a representation through their website www.avant.com.

Is Avant safe and legitimate to use?

Although relatively new, Avant has a great rating with the BBB.

All the loans are distributed by an FDIC-insured industrial bank called WebBank.

The bank is accredited with the BBB and also scored an A+.

This proves the assurance that Avant is a legitimate and safe lending option.

Strengths

- Can apply with a low credit score

- Excellent customer service 7 days per week

- Late fee forgiveness

- Reports to Credit Bureaus

Weaknesses

- High APR

Contact Information

Headquarters:

Avant

222 N. LaSalle St., Suite 1700

Chicago, Illinois 60601

Customer Support: 800.712.5407

Monday – Friday: 7:00am – 10:00pm Central

Saturday – Sunday: 7:00am – 8:00pm Central

Fax: 866.625.0930

Email: support@avant.com

Website: www.avant.com

Twitter: @Avant_US

Facebook: www.facebook.com/avantusa/

U.S.: Chicago & Los Angeles U.K.: London