Taking that long walk across the stage and accepting your diploma is the first step towards the rest of your life. Congratulations!

You're likely filled with excitement, but maybe a little dread too.

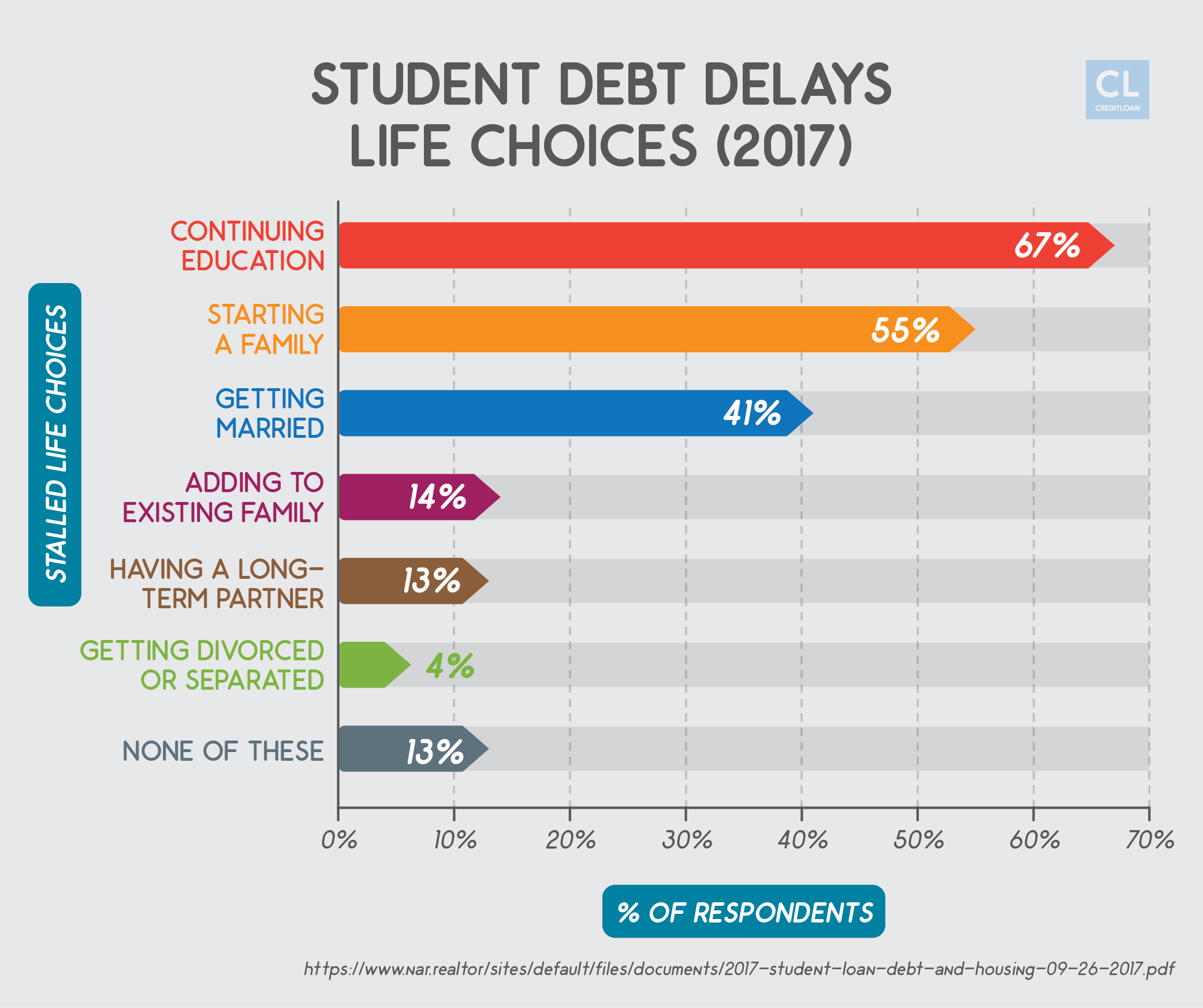

After all, you know what comes next: student loan repayments.

I know how daunting the prospect of paying back thousands upon thousands of dollars of debt can be, especially if you don't have a job lined up.

You may have anywhere from $30,000–$300,000 in loans waiting for that first payment.

Unfortunately, even if you declare bankruptcy, excessive lobbying has made it difficult to rid yourself of student loans.

The good news is that there are multiple plans that will help you pay back your students loans in the most efficient way possible.

You won't have to look forward to 10+ years of payments.

We've broken this article into three distinct parts:

How loans work according to the government. Do you understand why payment plans are structured as they are and what your options are if that plan doesn't work for you?

What to know before you begin making payments. Do you know who your loan servicer is or if you qualify for loan forgiveness?

A step-by-step guide to getting out of debt. Imagine a life free of student loan debt.

Like that image?

With the tips below, you can take care of your student loans in as little as three years depending on what you owe.

How Federal Loan and Repayment Plans Work

The lower your monthly payment, the more interest you'll pay overall on your student loan

The government offers three main repayment plans for your student loans. While your monthly payments will be "low," the longer the plan the more you'll pay in interest.

You can check with your loan servicer (the company that handles the billing and other services on your federal student loan) to verify which plan you have.

Unless you've chosen a different option you will have the standard plan by default.

The standard repayment plan is 10 years. This involves making equal monthly payments every month and will save you the most money of all the plans.

The graduated repayment plan is 10 years. The payments begin low and then increase every two years as your income grows

The extended repayment plan is 25 years. This plan gives you lower monthly payments but you will pay significantly more in interest over time.

The government allows you to pay back your loan based on your income

If you aren't in a position to pay back your loans yet, you can apply for an income-driven repayment plan.

Your payments per month on these plans are based on how much you earn and require you to recertify your income each year.

However, if you qualify for one of these plans you will end up paying more interest over time than if you pay the loan off more quickly.

The "income-based" repayment plan lasts 20–25 years. You will pay 10–15% of your discretionary income.

Discretionary income is considered the amount by which your adjusted gross income (AGI) exceeds the poverty line.

The government will consider your outstanding debt and income, your family size, and state of residence when you apply for this plan.

A quick formula for determining income-based repayment is IBR=15%(AGI-150% x poverty line)/12.

If this is confusing, take this easier example:

If you make $30,000 per year, you would pay around $148.46 per month.

You subtract 150% of the poverty line ($18,123) from $30,000 and multiply the result by 15% to get your yearly payment, then divide the yearly payment by 12 for the monthly payment.

The "income-contingent" repayment plan lasts for 25 years. You will pay up to 20% of your monthly income on this plan.

You should note this plan is the only income-driven option that PLUS loan borrowers can qualify for.

The "Pay As You Earn" (PAYE) plan lasts 20 years. The monthly income percentage cap is 10%.

The "Revised Pay As You Earn" plan lasts 20–25 years. You will pay up to 10% of your monthly income.

The benefit of this plan is that any borrower with a federal direct loan qualifies (that is, a loan directly from the school supplied by the US Department of Education, not a private lender).

3 Things You Need to Know About Your Student Loans

Like Sun Tzu said, "Know thy enemy." To pay off your student loans most effectively, there are a few things you need to know about them.

1. Know your loan servicer. To find out who your loan servicer is, first go to the National Student Loan Database and click "Financial Aid Review."

Use your FSA ID to log-in, or create one if necessary.

Once you've logged in, you'll see a big list of all the student loans you have.

Just click the individual number to expand the information and you will see the contact info and name of your loan servicer underneath.

There are nine main federal student loan servicing companies:

- CornerStone

- MOHELA

- FedLoan Servicing

- Navient

- Granite State

- Nelnet

- Great Lakes Education Loan Services, Inc.

- OSLA Servicing

- HESC/Edfinancial

You will go to these companies' websites to make student loan payments, apply for deferment, and to manage your account.

If you don't have an account with your servicer, its website will provide you with instructions on how to create one.

2. Know the difference between subsidized and unsubsidized student loans. The difference between subsidized and unsubsidized loans is subtle but important.

It all comes down to interest.

The federal government pays the interest on Direct Subsidized Loans while a student is in college or while the loan is in deferment, while Direct Unsubsidized Loans begin accruing interest as soon as they are issued.

This means some of the loans may be building interest for four years or more—especially when you consider that most people don't begin thinking about student loans until after graduation.

Unsubsidized loans can be up to a maximum of $20,500, while Subsidized loans max out at $5,500.

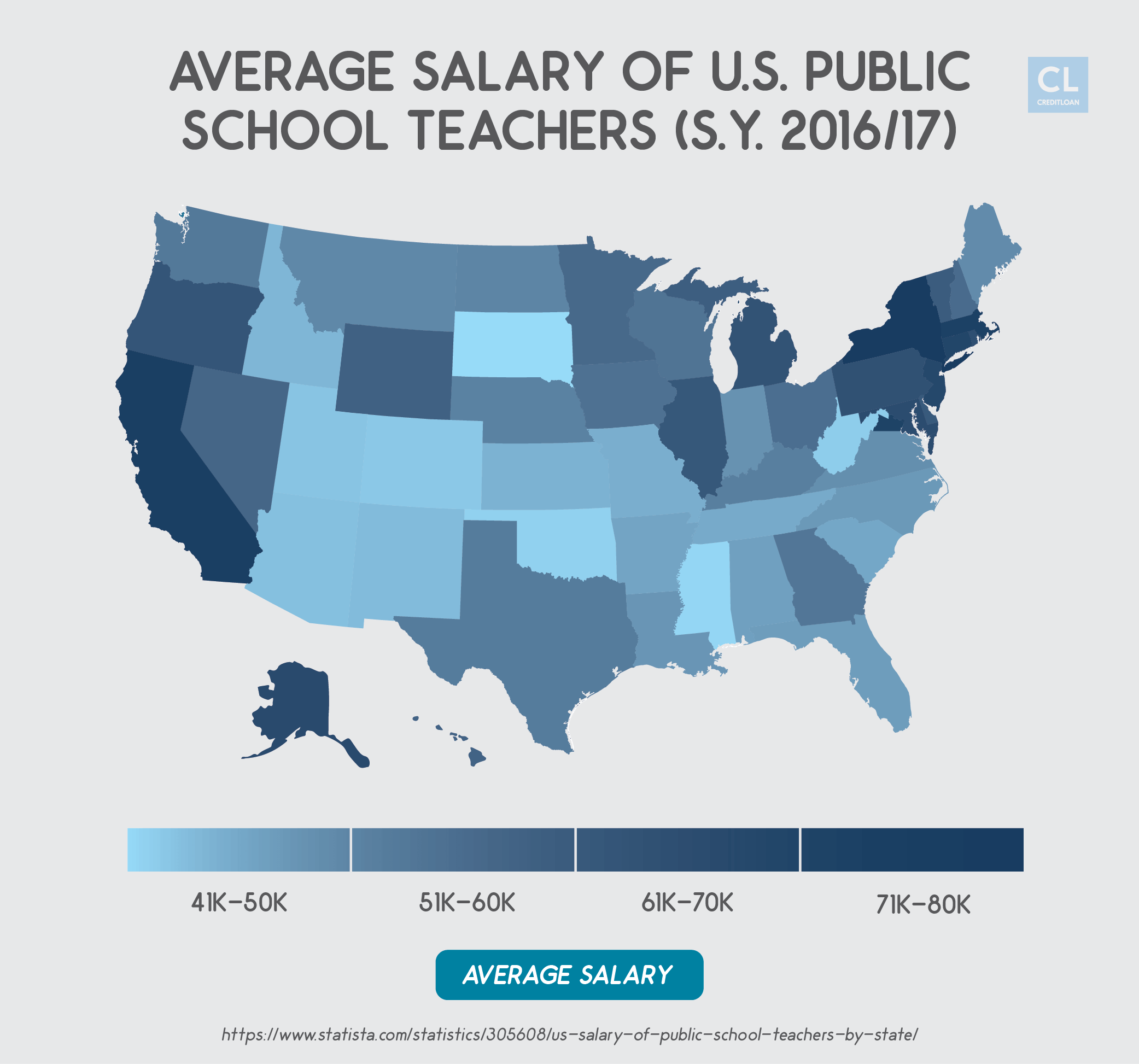

3. Find out if you qualify for student loan forgiveness. Certain professions allow you to be forgiven of your debt if you make a certain number of payments on time.

Teachers most commonly see their loans forgiven, but government employees and public service employees may also qualify.

A Simple 8-Step Guide to Repaying Your Student Loans

Repaying student loans is never easy, but you can lessen the burden by developing a strategic approach to repaying your loans.

Here is an easy-to-follow plan for taking care of your student debt in a reasonable amount of time.

1. Calculate your student loan payoff date

Some people might call this their "Freedom" date—the day when they make their last payment and no longer have to worry about student loans.

The US Department of Education provides a free online calculator to help you determine how long it will take you to pay off your student loans.

You can log in to the website and see calculations based on your actual loan information, or you can use the calculator by entering the information yourself.

This tool will help you estimate how long it will take to pay off your loans currently as well as how long it might take if you use a federal repayment plan.

2. Make more than the required monthly payment

The average monthly payment for a student with $25,000 in debt is around $280 per month.

For someone fresh out of school and looking for a job, that can be a lot of money. At that rate, it would take around 10 years to pay off the total debt.

With interest, the total amount paid would be around $34,000.

If you could pay $100 more per month, it would only take roughly 7.5 years to pay off your debt—and save you significantly more money in terms of interest.

Even if you can only pay $20 more per month, every little bit helps.

3. Try to avoid repayment programs

It can be tempting to take a federal repayment program if offered. After all, you'll have lower monthly payments and more money in your pocket.

While these programs may be unavoidable if you are struggling to make your monthly payments, they also extended the length of the loan and the total amount you pay in interest.

These programs trade the instant gratification of having money right now for more expensive payments in the long run.

If you can't make ends meet because of high student loan payments, then take one of the repayment programs in the short term, but start making more than the minimum payment as soon as possible.

4. Cut expenses and put those savings towards loan repayment

One of the easiest ways to pay off your student loans faster is to avoid spending money on unnecessary things.

Making a budget may seem dull, but it can help you see exactly how much you spend each month.

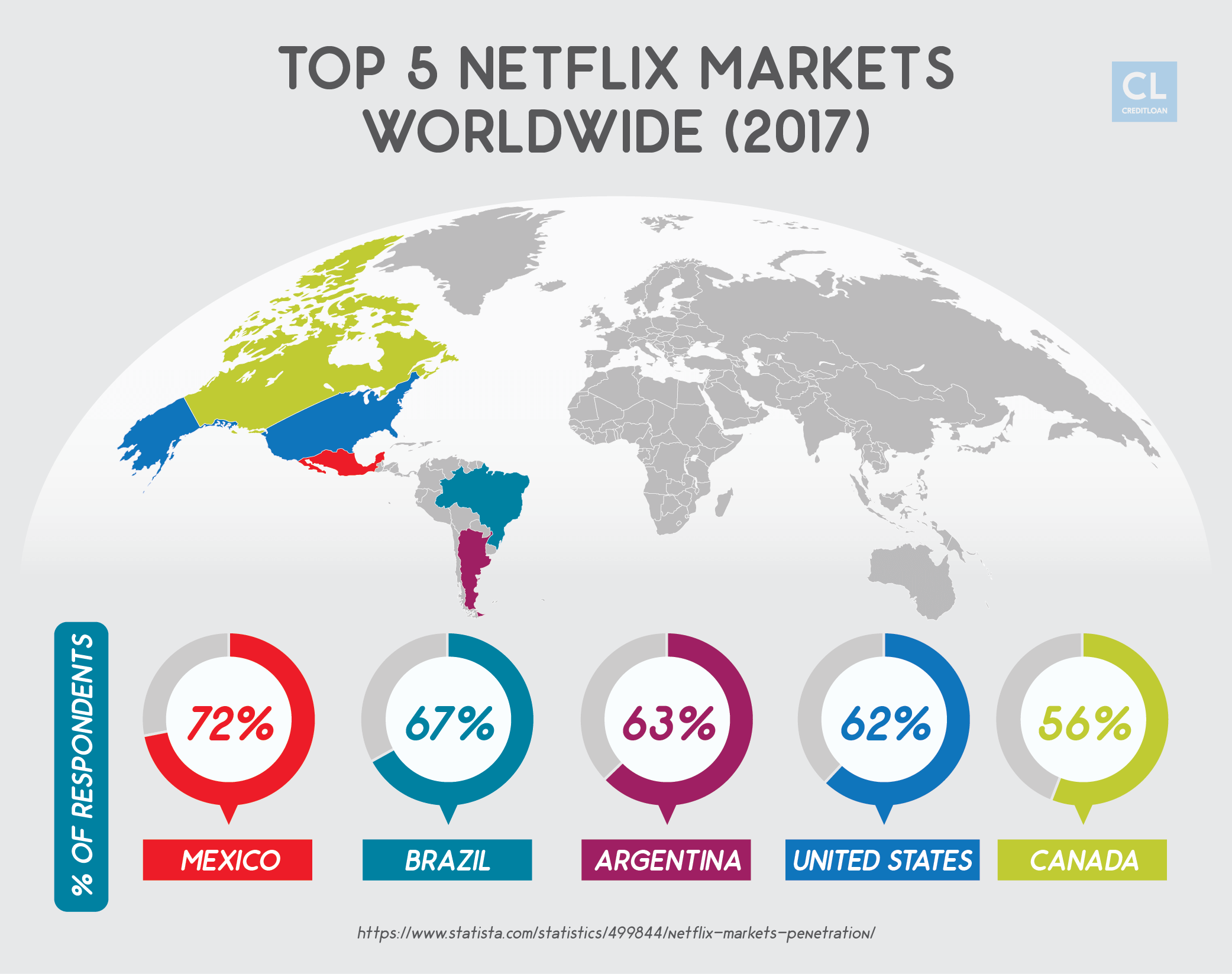

Cancel cable and use Netflix/Hulu. You can keep up with your favorite shows without letting Big Cable rule your wallet.

Both Netflix and Hulu are far cheaper than a monthly cable bill and still provide comparable levels of entertainment.

Avoid dining out. The average American household spends $3,008 each year by dining out rather than cooking their own meals.

By cooking even a few meals each week, you can cut back your restaurant expenses by hundreds or thousands of dollars.

Cut back on alcohol. According to the Bureau of Labor Statistics, the average American spends about 1% of their total annual income on alcohol.

While drinking at home is certainly less expensive than drinking at a bar, it can still add up quickly. Cutting back on consumption can reduce spending significantly.

Small savings add up to big results

All of the money saved from expenses like these can be put towards your student loan debt and allow you to pay off the amount you owe much more quickly.

Just take a look:

Netflix costs $7.99 per month for the basic plan, while the average cable bill is $103.10.

Paying the basic plan on Netflix for a year ($95.88) is less than a single month of cable.

Cutting cable and using Netflix for a year for entertainment means saving $1,141.32.

You could pay off your student loans in a matter of a few years versus a decade by making modest changes to your lifestyle.

5. Consolidate and refinance your loans

One of the principle struggles of debt repayment is paying off the principal.

When interest rates are too high, much of your expenses go towards paying interest costs rather than reducing the actual amount you owe.

If you are struggling to pay more than the minimum each month and are racking up interest as a result, consider consolidating or refinancing your loans.

Doing so will provide you with a single monthly payment that often has a lower interest rate.

If that isn't an option for you, consider refinancing your highest-rate loan for one with lower interest amounts.

You need strong credit to refinance. A credit score in the mid-600s is ideal if you're trying to refinance.

You'll also want a low debt-to-income ratio (the percentage of your monthly income that goes towards paying debts) and reasonable credit history.

Refinancing terms may be shorter than your current period. While most student loan repayment plans last 10–30 years, refinancing agencies usually have terms of 5–20 years.

Rates may be as low as 2.5–3%. These rates are far lower than those offered by the federal government or private lenders.

Consolidating can combine multiple loan payments into a single payment

Imagine you have three loans: one with a $1,000 principle and 25% interest, one with a $500 principle and a 20% interest, and a final loan with a $2,500 principle and 10% interest.

That's three monthly payments you need to remember, but if you consolidate, you may be able to get a single payment on a $5,000 loan with 0% interest for a set amount of time.

Taking advantage of this zero-interest period allows you to pay off the principle more quickly without wasting money on interest payments.

6. Take advantage of interest rate reductions

Read the terms of your loan carefully. Many loan servicers offer rate cuts of 0.25% to 0.50% for enrolling in automatic payments.

Take advantage of as many of these reductions as you can.

Even small reductions like that of automatic debit can help over time.

For example, if you have an interest rate of 6.5% on a $25,000 loan with a 10-year repayment plan, you're going to pay just over $9,000 in interest.

A reduction of 0.50% in your rate would bring that to just $8,306 in interest.

7. Seek out a job that offers loan forgiveness

There are three main professions that provide the option for eventual student loan forgiveness: teaching, public servitude, and healthcare.

The Teacher Loan Forgiveness Program can forgive up to $17,500 of debt. To qualify, you would need to teach full-time for five consecutive years in a low-income school or for an educational service agency.

This program doesn't forgive private loans, but only Direct Subsidized and Unsubsidized loans issued by the federal government.

The Public Service Loan Forgiveness (PSLF) Program can wipe balances. The PSLF can forgive any remaining balance after you have made 120 qualified payments.

The danger of this program is that many applicants wait to apply until they've made unqualified payments for several years.

Submit the Employment Certification form as soon as possible to ensure every payment you make is qualified for this program.

You may be able to cancel your Federal Perkins Loan. The Federal Perkins Loan is popular among teachers, but a number of other professions also qualify, including librarians, speech-language pathologists, and nurses.

To be eligible for this cancellation, you must work in a qualifying profession for at least one year. Other requirements vary by profession, but if you are interested, speak to your loan servicer and ask what your options are.

8. Take advantage of tax exemptions and credits

The amount you pay on your student loans qualifies you for certain tax exemptions and credits each year.

You will receive a 1098-E if you pay interest on student loans. The interest you pay on your student loans qualifies you for a tax deduction.

You will only receive a 1098-E if you paid more than $600 in interest in the past year, but you can still take the deduction without the form.

If you paid tuition, you may qualify for the American Opportunity Tax Credit. This credit covers the first $2,000 in qualified expenses and an additional 25% of expenses after that to a max of $2,500.

You may also be eligible for qualified education expenses. If you spent money on tuition, student fees, or even textbooks, there may be other deductions you qualify for.

When tax time rolls around this coming year, speak with your tax professional or use a tax preparation program to look for potential deductions.

Pay off your student loans and be free of the burden

After you graduate, the last thing you want to do is think about something else hanging over your head.

You just finished four (or more) years of hard work and have your whole life ahead of you.

Read the above steps several times and make a plan of action.

Set up loans to deduct automatically from your paycheck each month. That way you get used to making a payment regularly.

You can also work towards saving a little bit of money here and there to make lump sum payments.

Paying off student loans is a necessity, but the burden doesn't have to control your life.

Do you think we missed anything related to student loans?

How have you tackled your student debt?

If you have any tips or tricks to share with us, please let us know in the comments below.